730x Filetype XLSX File size 0.04 MB Source: datashop.cboe.com

Sheet 1: Exchange Codes

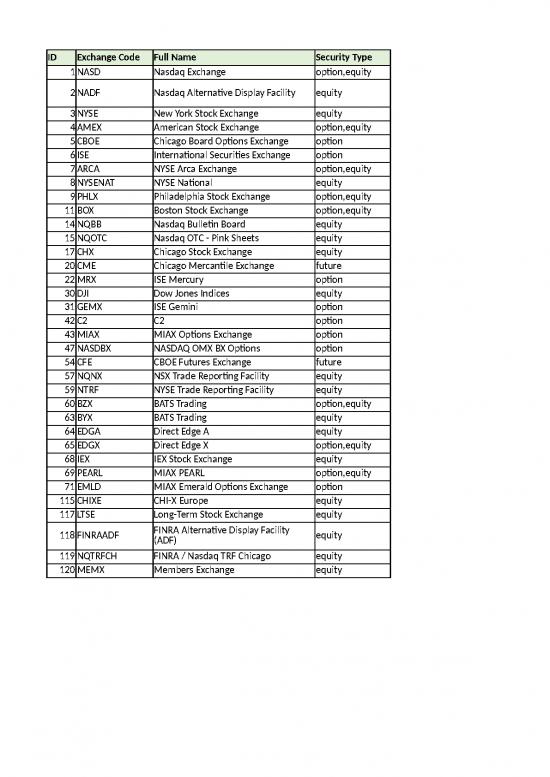

| ID | Exchange Code | Full Name | Security Type |

| 1 | NASD | Nasdaq Exchange | option,equity |

| 2 | NADF | Nasdaq Alternative Display Facility | equity |

| 3 | NYSE | New York Stock Exchange | equity |

| 4 | AMEX | American Stock Exchange | option,equity |

| 5 | CBOE | Chicago Board Options Exchange | option |

| 6 | ISE | International Securities Exchange | option |

| 7 | ARCA | NYSE Arca Exchange | option,equity |

| 8 | NYSENAT | NYSE National | equity |

| 9 | PHLX | Philadelphia Stock Exchange | option,equity |

| 11 | BOX | Boston Stock Exchange | option,equity |

| 14 | NQBB | Nasdaq Bulletin Board | equity |

| 15 | NQOTC | Nasdaq OTC - Pink Sheets | equity |

| 17 | CHX | Chicago Stock Exchange | equity |

| 20 | CME | Chicago Mercantile Exchange | future |

| 22 | MRX | ISE Mercury | option |

| 30 | DJI | Dow Jones Indices | equity |

| 31 | GEMX | ISE Gemini | option |

| 42 | C2 | C2 | option |

| 43 | MIAX | MIAX Options Exchange | option |

| 47 | NASDBX | NASDAQ OMX BX Options | option |

| 54 | CFE | CBOE Futures Exchange | future |

| 57 | NQNX | NSX Trade Reporting Facility | equity |

| 59 | NTRF | NYSE Trade Reporting Facility | equity |

| 60 | BZX | BATS Trading | option,equity |

| 63 | BYX | BATS Trading | equity |

| 64 | EDGA | Direct Edge A | equity |

| 65 | EDGX | Direct Edge X | option,equity |

| 68 | IEX | IEX Stock Exchange | equity |

| 69 | PEARL | MIAX PEARL | option,equity |

| 71 | EMLD | MIAX Emerald Options Exchange | option |

| 115 | CHIXE | CHI-X Europe | equity |

| 117 | LTSE | Long-Term Stock Exchange | equity |

| 118 | FINRAADF | FINRA Alternative Display Facility (ADF) | equity |

| 119 | NQTRFCH | FINRA / Nasdaq TRF Chicago | equity |

| 120 | MEMX | Members Exchange | equity |

| Code | Option Order Origin Type |

| A | Agency |

| B | Broker Dealer |

| C | Customer |

| F | Firm |

| J | Joint Back Office |

| L | Non-TPH Affiliate (C1 and C2) |

| M | Market Maker |

| N | Away Market Maker |

| P | Principal |

| R | Riskless Principal |

| U | Professional Customer |

| OPRA Message Type | OPRA Type Description | OPRA Message Type Value | LiveVol Trade Condition ID | LiveVol Trade Condition Name | OPRA Condition Description | Active From 11/7/2019 | |||

| A | CANC | 40 | Cancel | Transaction previously reported (other than as the last or opening report for the particular option contract) is now to be cancelled. | Active | ||||

| B | OSEQ | 2 | OutOfSeq | Transaction is being reported late and is out of sequence; i.e., later transactions have been reported for the particular option contract. | Active | ||||

| C | CNCL | 41 | CANCLAST | Transaction is the last reported for the particular option contract and is now cancelled. | Active | ||||

| D | LATE | 13 | SoldLast | Transaction is being reported late, but is in the correct sequence; i.e., no later transactions have been reported for the particular option contract. | Active | ||||

| E | CNCO | 42 | CANCOPEN | Transaction was the first one (opening) reported this day for the particular option contract. Although later transactions have been reported, this transaction is now to be cancelled. | Active | ||||

| F | OPEN | 6 | OpenReportOutOfSeq | Transaction is a late report of the opening trade and is out of sequence; i.e., other transactions have been reported for the particular option contract. | Active | ||||

| G | CNOL | 43 | CANCONLY | Transaction was the only one reported this day for the particular option contract and is now to be cancelled. | Active | ||||

| H | OPNL | 7 | OpenReportInSeq | Transaction is a late report of the opening trade, but is in the correct sequence; i.e., no other transactions have been reported for the particular option contract. | Active | ||||

| I | AUTO | 18 | AutoExecution | Transaction was executed electronically. Prefix appears solely for information; process as a regular transaction. | Active | ||||

| J | REOP | 21 | Reopen | Transaction is a reopening of an option contract in which trading has been previously halted. Prefix appears solely for information; process as a regular transaction. | Active | ||||

| S | ISOI | 95 | IntermarketSweep | Transaction was the execution of an order identified as an Intermarket Sweep Order. Process like normal transaction. | Active | ||||

| a | SLAN | Single Leg Auction Non ISO | 114 | SingLegAuctNonISO | Transaction was the execution of an electronic order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Soliciation Mechanism. | Active | |||

| b | SLAI | Single Leg Auction ISO | 115 | SingLegAuctISO | Transaction was the execution of an Intermarket Sweep electronic order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Solicitation Mechanism marked as ISO. | Active | |||

| c | SLCN | Single Leg Cross Non ISO | 116 | SingLegCrossNonISO | Transaction was the execution of an electronic order which was “stopped” at a price and traded in a two sided crossing mechanism that does not go through an exposure period. Such crossing mechanisms include and not limited to Customer to Customer Cross and QCC with a single option leg. | Active | |||

| d | SCLI | Single Leg Cross ISO | 117 | SingLegCrossISO | Transaction was the execution of an Intermarket Sweep electronic order which was “stopped” at a price and traded in a two sided crossing mechanism that does not go through an exposure period. Such crossing mechanisms include and not limited to Customer to Customer Cross. | Active | |||

| e | SLFT | Single Leg Floor Trade | 118 | SingLegFlr | Transaction represents a non-electronic trade executed on a trading floor. Execution of Paired and Non-Paired Auctions and Cross orders on an exchange floor are also included in this category. | Active | |||

| f | MLET | Multi Leg auto-electronic trade | 119 | MultLegAutoEx | Transaction represents an electronic execution of a multi leg order traded in a complex order book. | Active | |||

| g | MLAT | Multi Leg Auction | 120 | MultLegAuct | Transaction was the execution of an electronic multi leg order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period in a complex order book. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Solicitation Mechanism. | Active | |||

| h | MLCT | Multi Leg Cross | 121 | MultLegCross | Transaction was the execution of an electronic multi leg order which was “stopped” at a price and traded in a two sided crossing mechanism that does not go through an exposure period. Such crossing mechanisms include and not limited to Customer to Customer Cross and QCC with two or more options legs. | Active | |||

| i | MLFT | Multi Leg floor trade | 122 | MultLegFlr | Transaction represents a non-electronic multi leg order trade executed against other multi-leg order(s) on a trading floor. Execution of Paired and Non-Paired Auctions and Cross orders on an exchange floor are also included in this category. | Active | |||

| j | MESL | Multi Leg auto-electronic trade against single leg(s) | 123 | MultLegAutoSingLeg | Transaction represents an electronic execution of a multi Leg order traded against single leg orders/ quotes. | Active | |||

| k | TLAT | Stock Options Auction | 124 | StkOptAuct | Transaction was the execution of an electronic multi leg stock/options order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period in a complex order book. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Solicitation Mechanism. | Active | |||

| l | MASL | Multi Leg Auction against single leg(s) | 125 | MultLegAuctSingLeg | Transaction was the execution of an electronic multi leg order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period and trades against single leg orders/ quotes. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Solicitation Mechanism. | Active | |||

| m | MSFL | Multi Leg floor trade against single leg(s) | 126 | MultLegFlrSingLeg | Transaction represents a non-electronic multi leg order trade executed on a trading floor against single leg orders/ quotes. Execution of Paired and Non-Paired Auctions on an exchange floor are also included in this category. | Active | |||

| n | TLET | Stock Options auto-electronic trade | 127 | StkOptAutoEx | Transaction represents an electronic execution of a multi leg stock/options order traded in a complex order book. | Active | |||

| o | TLCT | Stock Options Cross | 128 | StkOptCross | Transaction was the execution of an electronic multi leg stock/options order which was “stopped” at a price and traded in a two sided crossing mechanism that does not go through an exposure period. Such crossing mechanisms include and not limited to Customer to Customer Cross. | Active | |||

| p | TLFT | Stock Options floor trade | 129 | StkOptFlr | Transaction represents a non-electronic multi leg order stock/options trade executed on a trading floor in a Complex order book. Execution of Paired and Non-Paired Auctions and Cross orders on an exchange floor are also included in this category. | Active | |||

| q | TESL | Stock Options auto-electronic trade against single leg(s) | 130 | StkOptAutoExSingLeg | Transaction represents an electronic execution of a multi Leg stock/options order traded against single leg orders/ quotes. | Active | |||

| r | TASL | Stock Options Auction against single leg(s) | 131 | StkOptAuctSingLeg | Transaction was the execution of an electronic multi leg stock/options order which was “stopped” at a price and traded in a two sided auction mechanism that goes through an exposure period and trades against single leg orders/ quotes. Such auctions mechanisms include and not limited to Price Improvement, Facilitation or Solicitation Mechanism. | Active | |||

| s | TFSL | Stock Options floor trade against single leg(s) | 132 | StkOptFlrSingLeg | Transaction represents a non-electronic multi leg stock/options order trade executed on a trading floor against single leg orders/ quotes. Execution of Paired and Non-Paired Auctions on an exchange floor are also included in this category. | Active | |||

| t | CBMO | Multi Leg Floor Trade of Proprietary Products | 133 | MultLegFlrPropProd | Transaction represents execution of a proprietary product non-electronic multi leg order with at least 3 legs. The trade price may be outside the current NBBO. | Active | |||

| Space Filled | REGULAR | 0 | Regular | Indicates that the transaction was a regular sale and was made without stated conditions. | History Only | ||||

| K | AJST | 34 | AdjTerms | Transaction is an option contract for which the terms have been adjusted to reflect a stock dividend, stock split, or similar event. Prefix appears solely for information; process as a regular transaction. | History Only | ||||

| L | SPRD | 35 | Spread | Transaction represents a trade in two options in the same class (a buy and a sell in the same class). Prefix appears solely for information; process as a regular transaction. | History Only | ||||

| M | STDL | 36 | Straddle | Transaction represents a trade in two options in the same class (a buy and a sell in a put and a call). Prefix appears solely for information; process as a regular transaction. | History Only | ||||

| N | STPD | 39 | STPD | Transaction is the execution of a sale at a price agreed upon by the floor personnel involved, where a condition of the trade is that it reported following a non-stopped trade of the same series at the same price. | History Only | ||||

| O | CSTP | 44 | CANCSTPD | Cancel stopped transaction. | History Only | ||||

| P | BWRT | 37 | BuyWrite | Transaction represents the option portion of an order involving a single option leg (buy or sell of a call or put) and stock. Prefix appears solely for information: process as a regular transaction. | History Only | ||||

| Q | CMBO | 38 | Combo | Transaction represents the buying of a call and the selling of a put for the same underlying stock or index. Prefix appears solely for information; process as a regular transaction. | History Only | ||||

| R | SPIM | 106 | StoppedIM | Transaction was the execution of an order which was “stopped” at a price that did not constitute a Trade-Through on another market at the time of the stop. Process like a normal transaction. | History Only | ||||

| T | BNMT | 107 | Benchmark | Transaction reflects the execution of a “benchmark trade”. A “Benchmark Trade” is a trade resulting from the matching of “Benchmark Orders”. A “Benchmark Order” is an order for which the price is not based, directly or indirectly, on the quote price of the option at the time of the order’s execution and for which the material terms were not reasonably determinable at the time a commitment to trade the order was made. Process like a normal transaction except don’t update “last”. | History Only | ||||

| X | XMPT | 108 | Trade through Exempt | Transaction is Trade Through Exempt. The transaction should be treated like a regular sale. | History Only |

no reviews yet

Please Login to review.