232x Filetype DOC File size 0.07 MB Source: www.bidnet.com

RIDER 104. INVOICING, PAYMENT AND TAXES

Supplier shall create a standard single invoice for each order in both paper and electronic formats. Additionally,

Supplier shall summarize multiple occurrences of individual stock items included in an order to a single line item on

both printed and electronic format invoices. Supplier will laser-print and format printed invoices as desired by UTMB.

Section 1. INVOICE ROUTING; FORMAT; TIMELINESS

1.1 Invoice Submission Location

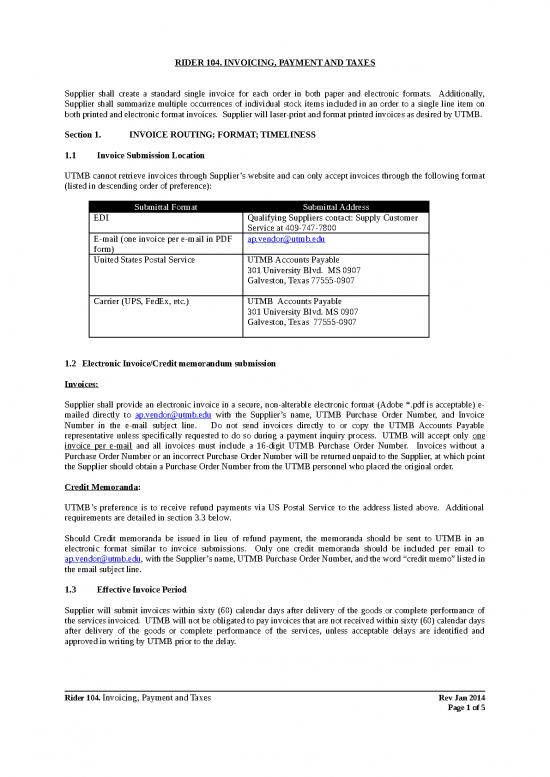

UTMB cannot retrieve invoices through Supplier’s website and can only accept invoices through the following format

(listed in descending order of preference):

Submittal Format Submittal Address

EDI Qualifying Suppliers contact: Supply Customer

Service at 409-747-7800

E-mail (one invoice per e-mail in PDF ap.vendor@utmb.edu

form)

United States Postal Service UTMB Accounts Payable

301 University Blvd. MS 0907

Galveston, Texas 77555-0907

Carrier (UPS, FedEx, etc.) UTMB Accounts Payable

301 University Blvd. MS 0907

Galveston, Texas 77555-0907

1.2 Electronic Invoice/Credit memorandum submission

Invoices:

Supplier shall provide an electronic invoice in a secure, non-alterable electronic format (Adobe *.pdf is acceptable) e-

mailed directly to ap.vendor@utmb.edu with the Supplier’s name, UTMB Purchase Order Number, and Invoice

Number in the e-mail subject line. Do not send invoices directly to or copy the UTMB Accounts Payable

representative unless specifically requested to do so during a payment inquiry process. UTMB will accept only one

invoice per e-mail and all invoices must include a 16-digit UTMB Purchase Order Number. Invoices without a

Purchase Order Number or an incorrect Purchase Order Number will be returned unpaid to the Supplier, at which point

the Supplier should obtain a Purchase Order Number from the UTMB personnel who placed the original order.

Credit Memoranda:

UTMB’s preference is to receive refund payments via US Postal Service to the address listed above. Additional

requirements are detailed in section 3.3 below.

Should Credit memoranda be issued in lieu of refund payment, the memoranda should be sent to UTMB in an

electronic format similar to invoice submissions. Only one credit memoranda should be included per email to

ap.vendor@utmb.edu, with the Supplier’s name, UTMB Purchase Order Number, and the word “credit memo” listed in

the email subject line.

1.3 Effective Invoice Period

Supplier will submit invoices within sixty (60) calendar days after delivery of the goods or complete performance of

the services invoiced. UTMB will not be obligated to pay invoices that are not received within sixty (60) calendar days

after delivery of the goods or complete performance of the services, unless acceptable delays are identified and

approved in writing by UTMB prior to the delay.

Rider 104. Invoicing, Payment and Taxes Rev Jan 2014

Page 1 of 5

RIDER 104. INVOICING, PAYMENT AND TAXES

1.4 Third Party Invoicing

UTMB does not accept invoicing from third parties acting on behalf of the Supplier.

Section 2. ACCURATE BILLING

2.1 Invoice Requirements

Each invoice must include:

Billing related to only one valid 16-digit UTMB Purchase Order Number.

A valid UTMB Purchase Order Number clearly stated on the face of the invoice.

The Supplier’s legal name, “remit to” address, telephone, email address, and fax number.

A uniquely assigned invoice number.

An invoice date.

The UTMB “bill-to” address.

The UTMB “ship-to” address.

The correct invoice amount matching the UTMB Purchase Order (invoices that contain an incorrect amount or

a disputed amount will need to be revised and resubmitted by the Supplier).

For goods, the manufacturer's part number, item description, quantity shipped, and unit price.

For services, a clear description of exact services rendered

A separate line item for all freight, shipping and handling costs related to the invoice (not billed separately).

Line items must match UTMB Purchase Order line items (invoice line prices must exactly match, or be less

than, UTMB Purchase Order line items).

UTMB Logistics/Digimax invoices must be sent via EDI separately from PeopleSoft invoices.

With the exception of EDI invoices, each invoice must be a standard typed original invoice on Supplier letterhead.

UTMB will not make payments based on statements, quotations, service contracts, shipping/packing slips, calculator

tapes, work orders, pro-forma statements, Letters of Intent, Memoranda of Understanding, or other non-invoice

documents.

2.2 Deductions

UTMB may reduce payment to Supplier for the following reasons:

Sales Tax (for more information, refer to Section 7.1 of this Rider 104).

Negotiated price is less than invoice price.

o Supplier should not ship goods or provide services if proposed invoice price/quantity does not match

exactly with UTMB’s Purchase Order

2.3 Credit Memoranda

Credit memoranda submitted to UTMB must include the Invoice Requirements set out in Section 3.1 of this Rider 104,

as well as the following:

UTMB’s preference is to receive refund payments rather than credit memoranda.

o Refund payments must reference the original UTMB Purchase Order Number, Invoice Number, and

description of goods

Written credit memoranda will be processed as follows:

o The phrase “Credit Memo” must appear in clear and apparent text.

o A uniquely assigned Credit Memo number must be shown on the face of the document

o A description of the goods or services credited and original invoice number.

o A valid Purchase Order Number against which UTMB may credit the Credit Memo amount.

Rider 104. Invoicing, Payment and Taxes Rev Jan 2014

Page 2 of 5

RIDER 104. INVOICING, PAYMENT AND TAXES

2.4 Validating Purchase Orders

Purchase Orders for purchases not authorized by UTMB will be considered invalid. Invalid Purchase Orders may be

researched by contacting the “Buyer” listed in the header of the UTMB Purchase Order. If the Buyer is unknown,

Supplier may contact the UTMB Logistics Department at 713-745-8300 for GHX Orders and UTMB Purchasing

Helpdesk for PeopleSoft Purchase Orders at 281-338-8056.

Section 3. ACH PAYMENT DISBURSEMENT METHOD

3.1 Preferred Payment Method

Automated Clearing House (ACH): UTMB’s preferred process for settling financial obligations is to utilize the

National Automated Clearing House Association (NACHA) standard Cash Concentration and Disbursement (CCD)

format. This industry standard process is widely utilized and recognized by payees as the most efficient, safe and

timely way to transfer funds. UTMB’s goal is that every payment by UTMB be made via electronic funds transfers,

unless legally prohibited. This service may be set up by completing the following Direct Deposit form and returning it

to UTMB per instructions at the bottom of the form:

https://ispace.utmb.edu/xythoswfs/webui/_xy-e5672986_1

Alternatively, the Supplier Management team at UTMB can assist via email (supplier.mgmt@utmb.edu) or by

telephone at 281-338-8056.

Upon payment initiation, Supplier will receive a direct deposit of funds to your designated bank account and an email

containing the associated remittance details.

3.2 Check Disbursement

UTMB initiates payment disbursements on Wednesdays and Fridays, with typical funds availability the following

business day.

3.3 Accounts Payable Invoice Approval Process

Goods: UTMB requires a 3-way match for payment on Purchase Orders for goods. The 3-way match includes a

UTMB Purchase Order, a UTMB Materials Management Receipt, and a Supplier Invoice. All items must match with

respect to quantity, price, and receipt in order for a payment to successfully remit to a Supplier.

Services: UTMB requires a 2-way match for payment on Purchase Orders for services. The 2-way match includes a

UTMB Purchase Order and a Supplier Invoice. In addition, complete performance of services must be verified by an

appropriate UTMB representative before an invoice for such services will be paid unless otherwise stated in the

Agreement. All items must match with respect to quantity, price, and verified acceptable performance of services in

order for a payment to successfully remit to a Supplier.

Section 4. SUPPLIER INQUIRY OPTIONS

4.1 Payment Inquiry

Supplier may research invoice status by contacting the UTMB Accounts Payable Department through the

following methods (a UTMB Purchase Order Number and/or Supplier Invoice Number is required):

Email (questions only): appurord@utmb.edu

o Subject line should contain the UTMB Purchase Order number, invoice number and supplier name

as well as the phrase “Payment Status”.

o Do not include attachments.

Telephone: 409-747-7259

Rider 104. Invoicing, Payment and Taxes Rev Jan 2014

Page 3 of 5

RIDER 104. INVOICING, PAYMENT AND TAXES

4.2 Reconciliation of Payment

UTMB notifies Supplier that invoices have been paid by payment stub for standard check payments and e-mail for

ACH payments.

4.3 Credit Hold

Supplier shall not suspend shipments of goods or performance of services unless Supplier complies with Subchapter D,

Chapter 2251, Texas Government Code. Supplier must provide UTMB at least ten (10) days prior written notice of its

intent to suspend performance (the “Suspension Notice”). Notwithstanding any other requirements for notices given by

Supplier under the Contract, if Supplier intends to deliver a Suspension Notice to UTMB pursuant to Texas

Government Code Section 2251.054, Supplier must send such notice to UTMB to the following address:

The University of Texas Medical Branch at Galveston

Supply Chain – Accounts Payable

301 University Blvd (campus mail route 0907)

Galveston, Texas 77555-0907

Notice must contain specific information regarding the suspension. Applicable Purchase Order Numbers and invoice

numbers must be referenced in the Suspension Notice.

Section 5. MATERIALS MANAGEMENT

5.1 Freight

UTMB does not accept Collect on Delivery (C.O.D.) shipping.

5.2 Receiving

All deliveries must reference a valid UTMB Purchase Order Number or risk being turned away. Purchase Orders for

goods not delivered to a UTMB shipping location as indicated on the Purchase Order risk payment delays, unless

otherwise stated in the Agreement.

Section 6. GOVERNING LAWS

6.1 Taxes

UTMB is a tax-exempt agency of the State of Texas and an institution of higher education. Notwithstanding its

exemption from certain state taxes, UTMB will be responsible for any taxes (except corporate income taxes, franchise

taxes, and taxes on Supplier’s personnel, including but not limited to personal income tax and social security taxes)

from which UTMB is not exempt. Supplier will provide reasonable cooperation and assistance to UTMB in obtaining

any tax exemptions to which UTMB is entitled.

6.2 W-9

UTMB requires Supplier to have a valid W-9 on file with UTMB prior to all disbursements. Supplier may download a

W-9 form from UTMB’s Supply Chain Management website at:

http://www.utmb.edu/supplychain/purchasing/forms/UTMB%20Vendor%20Application.pdf

6.3 Prompt Payment Act

All funds held by UTMB are subject to the Texas Prompt Payment Act, Chapter 2251, Texas Government Code.

Unless specifically agreed upon by UTMB and Supplier contractually, late payment fees owed by UTMB will be

determined based upon the fee structures promulgated by the Texas Comptroller’s Office in accordance with the

Prompt Payment Act.

Rider 104. Invoicing, Payment and Taxes Rev Jan 2014

Page 4 of 5

no reviews yet

Please Login to review.