241x Filetype DOCX File size 0.07 MB Source: mtnl.in

Annexure- I

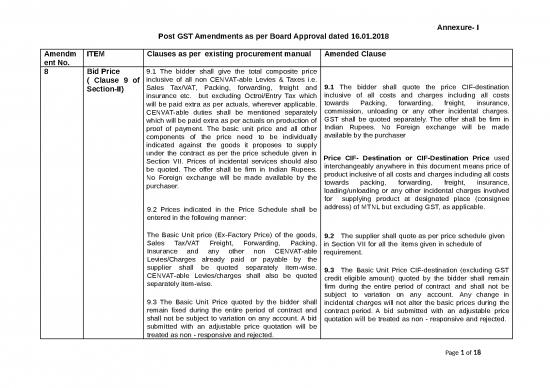

Post GST Amendments as per Board Approval dated 16.01.2018

Amendm ITEM Clauses as per existing procurement manual Amended Clause

ent No.

8 Bid Price 9.1 The bidder shall give the total composite price

( Clause 9 of inclusive of all non CENVAT-able Levies & Taxes i.e.

Section-II) Sales Tax/VAT, Packing, forwarding, freight and 9.1 The bidder shall quote the price CIF-destination

insurance etc. but excluding Octroi/Entry Tax which inclusive of all costs and charges including all costs

will be paid extra as per actuals, wherever applicable. towards Packing, forwarding, freight, insurance,

CENVAT-able duties shall be mentioned separately commission, unloading or any other incidental charges.

which will be paid extra as per actuals on production of GST shall be quoted separately. The offer shall be firm in

proof of payment. The basic unit price and all other Indian Rupees. No Foreign exchange will be made

components of the price need to be individually available by the purchaser

indicated against the goods it proposes to supply

under the contract as per the price schedule given in Price CIF- Destination or CIF-Destination Price used

Section VII. Prices of incidental services should also interchangeably anywhere in this document means price of

be quoted. The offer shall be firm in Indian Rupees. product inclusive of all costs and charges including all costs

No Foreign exchange will be made available by the towards packing, forwarding, freight, insurance,

purchaser. loading/unloading or any other incidental charges involved

for supplying product at designated place (consignee

9.2 Prices indicated in the Price Schedule shall be address) of MTNL but excluding GST, as applicable.

entered in the following manner:

The Basic Unit price (Ex-Factory Price) of the goods, 9.2 The supplier shall quote as per price schedule given

Sales Tax/VAT Freight, Forwarding, Packing, in Section VII for all the items given in schedule of

Insurance and any other non CENVAT-able requirement.

Levies/Charges already paid or payable by the

supplier shall be quoted separately item-wise. 9.3 The Basic Unit Price CIF-destination (excluding GST

CENVAT-able Levies/charges shall also be quoted credit eligible amount) quoted by the bidder shall remain

separately item-wise. firm during the entire period of contract and shall not be

subject to variation on any account. Any change in

9.3 The Basic Unit Price quoted by the bidder shall incidental charges will not alter the basic prices during the

remain fixed during the entire period of contract and contract period. A bid submitted with an adjustable price

shall not be subject to variation on any account. A bid quotation will be treated as non - responsive and rejected.

submitted with an adjustable price quotation will be

treated as non - responsive and rejected.

Page 1 of 18

Annexure- I

Post GST Amendments as per Board Approval dated 16.01.2018

9.4 The prices quoted by the bidder shall be in

sufficient detail (including details of CENVAT-able & 9.4 “DISCOUNT, if any, offered by the bidders shall not be

non CENVAT-able duties) to enable the Purchaser to considered unless specifically indicated in the price

arrive at the price of equipment/system offered. It is schedule of the bid. Bidders offering discount shall

mandatory to quote CENVAT-able duties as per therefore modify their offers suitably while quoting and shall

prevailing duties at the time of submission of the bid. quote clearly net price taking all such factors like Discount,

free supply etc. into account”.

9.5 DISCOUNT, if any, offered by the bidders shall not

be considered unless specifically indicated in the price

schedule. Bidders desiring to offer discount shall In addition to above, in case the discount is not quoted in

therefore modify their offers suitably while quoting price schedule separately and discount is provided to the

and shall quote clearly net price taking all such factors purchaser post supply then the same will be considered as

like Discount, free supply, etc, into account”. value of supply and accordingly supplier shall raise a credit

note to MTNL. In case supplier fails to raise credit note in

9.6 The price approved by MTNL for procurement will time then MTNL shall be authorised to raise a debit note

be inclusive of non CENVAT-able Levies and Taxes, against such discount plus applicable GST. Such

credit/debit note shall be issued before September 30th of

packing, forwarding, freight and insurance as

mentioned in para 9.1 above but excluding CENVAT- following end of financial year in which such supply was

able duties which will be paid extra on production of made.

proof of payment. Break up in various heads of non 9.5 (a) Benefit in custom duty, if any, on account of

CENVAT-able duties i.e., Sales tax, insurance, freight “infrastructure projects” shall be passed on to MTNL.

and other taxes paid/payable as per clause 9.2 (i) is for The bidder is expected to take action for arranging

the information of the purchaser and any change in infrastructure benefits available for telecom sector. It is

these shall have no effect on price during the the responsibility of the bidder to avail the reduced rate of

scheduled delivery period. custom duty as applicable.

9.7 Changes, if any, requested by the bidders for

supply of indigenous items in place of imported (b) The goods may be shipped in the name of MTNL. The

items and vice versa, quoted in the bids, may be vendor shall be responsible for custom clearance,

considered only on the lower of the two rates. insurance and transportation till the commissioning and

handing over of the system to MTNL etc. on behalf of

MTNL, including payment of custom duty, insurance,

freight and other charges, if any. MTNL will issue

necessary letter of authorization, if required, for the

purpose of claiming concessional custom duty as per 9.5(a)

Page 2 of 18

Annexure- I

Post GST Amendments as per Board Approval dated 16.01.2018

whenever applicable.

9.6 Changes, if any, requested by the bidders for

supply of indigenous items in place of imported items

and vice versa, quoted in the bids, may be considered only

on the lower of the two rates.

9 Evaluation 22.1 The Purchaser shall evaluate in detail and 22.1 The Purchaser shall evaluate in detail and

compare the bids previously determined to be compare the bids previously determined to be

& comparison substantially responsive pursuant to clause 21. substantially responsive pursuant to clause 21.

Of substantially

responsive 22.2 The evaluation and comparison of responsive 22.2 The evaluation and comparison of responsive bids

bids. bids shall be done on the basis of net cost to MTNL on shall be done on the basis of Net cost to MTNL excluding

( Clause 22 of the price of goods offered inclusive of Duties and GST Credit-eligible Amount (as given in price schedule of

Section-II) Taxes (but excluding CENVAT-able Duties & Taxes) Section-VII Part-II of the bid document). .

sales tax, packing, forwarding freight & insurance

charges etc. as indicated in col.13 of the Price

Schedule in Section VII Part-II of Bid Document. As

stipulated in Clause 9.1, Octroi/Entry taxes are not to

be included in the composite price and hence the

same will not be considered for the purpose of

evaluation and comparison of bids. However, Octroi /

Entry Taxes will be paid extra as per actuals wherever

applicable on production of proof of payment/relevant

invoices/documents.

10 Performance 4.1 The supplier shall furnish performance security to

Security the purchaser for an amount equal to 5% of the value PERFORMANCE SECURITY

( Clause 4 of of purchase order within 14 days from the date of issue

Section-III) of Advance Purchase Order by the Purchaser. The 4.1 The supplier shall furnish performance security to the

suppliers (small scale units) who are registered with purchaser for an amount equal to 5% of the value of

National Small Scale Industries Corporation UNDER purchase order within 14 days from the date of issue of

SINGLE POINT REGISTRATION SCHEME are Advance Purchase Order by the Purchaser. The suppliers

exempted from payment of performance security up to (small scale units) who are registered with National Small

the amount equal to their monetary limit. In case of Scale Industries Corporation UNDER SINGLE POINT

Page 3 of 18

Annexure- I

Post GST Amendments as per Board Approval dated 16.01.2018

suppliers having monetary limit as “NO LIMIT”, REGISTRATION SCHEME are exempted from payment of

“WITHOUT LIMIT”, or “MORE THAN Rs. 50 LAKHS”, performance security up to the amount equal to their

the exemption will be limited to Rs.50,00,000/- monetary limit. In case of suppliers having monetary limit

(Rupees Fifty Lakhs) only. A proof regarding current as “NO LIMIT”, “WITHOUT LIMIT”, or “MORE THAN Rs. 50

registration with NSIC for the TENDERED ITEMS will LAKHS”, the exemption will be limited to Rs.50,00,000/-

have to be attached along with the bid. (Rupees Fifty Lakhs) only. A proof regarding current

registration with NSIC for the TENDERED ITEMS will have

to be attached along with the bid.

4.2 The proceeds of the performance security

shall be payable to the Purchaser as compensation 4.2 The proceeds of the performance security shall be

for any loss resulting from the supplier’s failure to payable to the Purchaser for any deficiency in

complete its obligations under the contract. performance of contract and /or the supplier’s failure to

complete its obligations under the contract

4.3 The performance security bond shall be in the In case of adjustment of any amount from performance

form of Bank Guarantee issued by a scheduled Bank security with respect to supplier’s failure in

and in the form provided in „Section IX‟ of this Bid performance of contractor or deficiency in performance

Document. of contract then, Supplier shall raise a credit note to

MTNL. In case supplier fails to raise credit note in time

then MTNL shall be authorised to raise a invoice / debit

4.4 The performance security bond will be discharged note to vendor against such adjusted amount plus

by the Purchaser after completion of the supplier’s applicable GST. Such credit/debit note shall be issued

performance obligations including any warranty th

before September 30 of following end of financial year

obligations under the contract. in which such supply was made.

4.3 The performance security bond shall be in the form of

Bank Guarantee issued by a scheduled Bank and in the

form provided in „Section IX‟ of this Bid Document.

4.4 The performance security bond will be discharged by

the Purchaser after completion of the supplier’s

performance obligations including any warranty obligations

under the contract.

11 Payment 11.1 Payment of 95% of the prices (excluding 11. Payment Terms :

Terms for CENVAT-able duties and taxes) shall be made on A : For Supply & Services

Page 4 of 18

no reviews yet

Please Login to review.