278x Filetype DOCX File size 0.04 MB Source: dssmanuals.mo.gov

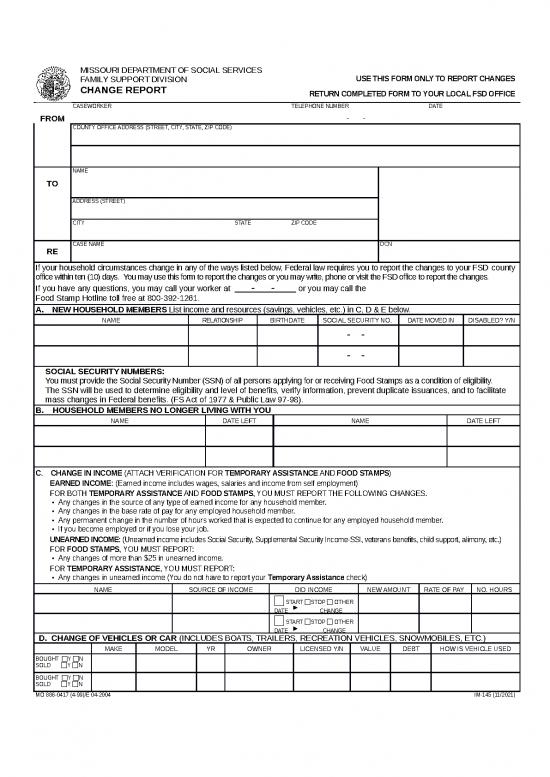

MISSOURI DEPARTMENT OF SOCIAL SERVICES

FAMILY SUPPORT DIVISION USE THIS FORM ONLY TO REPORT CHANGES

CHANGE REPORT RETURN COMPLETED FORM TO YOUR LOCAL FSD OFFICE

CASEWORKER TELEPHONE NUMBER DATE

FROM - -

COUNTY OFFICE ADDRESS (STREET, CITY, STATE, ZIP CODE)

NAME

TO

ADDRESS (STREET)

CITY STATE ZIP CODE

CASE NAME DCN

RE

If your household circumstances change in any of the ways listed below, Federal law requires you to report the changes to your FSD county

office within ten (10) days. You may use this form to report the changes or you may write, phone or visit the FSD office to report the changes.

If you have any questions, you may call your worker at - - or you may call the

Food Stamp Hotline toll free at 800-392-1261.

A. NEW HOUSEHOLD MEMBERS List income and resources (savings, vehicles, etc.) in C, D & E below.

NAME RELATIONSHIP BIRTHDATE SOCIAL SECURITY NO. DATE MOVED IN DISABLED? Y/N

- -

- -

SOCIAL SECURITY NUMBERS:

You must provide the Social Security Number (SSN) of all persons applying for or receiving Food Stamps as a condition of eligibility.

The SSN will be used to determine eligibility and level of benefits, verify information, prevent duplicate issuances, and to facilitate

mass changes in Federal benefits. (FS Act of 1977 & Public Law 97-98).

B. HOUSEHOLD MEMBERS NO LONGER LIVING WITH YOU

NAME DATE LEFT NAME DATE LEFT

C. CHANGE IN INCOME (ATTACH VERIFICATION FOR TEMPORARY ASSISTANCE AND FOOD STAMPS)

EARNED INCOME: (Earned income includes wages, salaries and income from self employment)

FOR BOTH TEMPORARY ASSISTANCE AND FOOD STAMPS, YOU MUST REPORT THE FOLLOWING CHANGES.

• Any changes in the source of any type of earned income for any household member.

• Any changes in the base rate of pay for any employed household member.

• Any permanent change in the number of hours worked that is expected to continue for any employed household member.

• If you become employed or if you lose your job.

UNEARNED INCOME: (Unearned income includes Social Security, Supplemental Security Income-SSI, veterans benefits, child support, alimony, etc.)

FOR FOOD STAMPS, YOU MUST REPORT:

• Any changes of more than $25 in unearned income.

FOR TEMPORARY ASSISTANCE, YOU MUST REPORT:

• Any changes in unearned income (You do not have to report your Temporary Assistance check)

NAME SOURCE OF INCOME DID INCOME NEW AMOUNT RATE OF PAY NO. HOURS

START STOP OTHER

DATE CHANGE

START STOP OTHER

DATE CHANGE

D. CHANGE OF VEHICLES OR CAR (INCLUDES BOATS, TRAILERS, RECREATION VEHICLES, SNOWMOBILES, ETC.)

MAKE MODEL YR OWNER LICENSED Y/N VALUE DEBT HOW IS VEHICLE USED

BOUGHT Y N

SOLD Y N

BOUGHT Y N

SOLD Y N

MO 886-0417 (4-99)/E 04-2004 IM-145 (11/2021)

E. INCREASE IN CASH SAVINGS, STOCKS, BONDS, CHECKING ACCOUNTS, ETC.

HOW MUCH DOES YOUR HOUSEHOLD NOW HAVE IN CASH/SAVINGS? (FOR FOOD STAMPS YOU MUST REPORT WHEN YOUR RESOURCES EXCEED $2,000.00) (FOR TEMPORARY

ASSISTANCE YOU MUST REPORT ALL CHANGES IN RESOURCES.)

F. IF YOU HAVE MOVED

WHEN? TELEPHONE NUMBER WHERE YOU CAN BE REACHED

- -

NEW MAILING ADDRESS (STREET, CITY, STATE, ZIP CODE)

HAVE YOU MOVED IN WITH SOMEONE ELSE? YES NO ARE YOU A BOARDER? YES NO

IF YES, PLEASE LIST HOUSEHOLD MEMBERS AT THIS ADDRESS

G. CHANGE IN RENT, MORTGAGE, OR UTILITIES (GAS, ELECTRICITY, OIL, ETC.) FOOD STAMPS ONLY

If you have moved, place a check (X) mark in the appropriate boxes for expenses you have at the new residence. N/A

Rent Amt $ Who pays? Water

Mortgage Amt $ Who pays? Sewer

Real Estate Taxes Amt $ Who pays? Trash

Property Insurance Amt $ Who pays?

Electric Used for: Heating Cooling Other

Gas/Propane Heating Cooling Other

H. CHANGE IN DEPENDENT CARE COSTS (ATTACH VERIFICATION) OPTIONAL IF FOOD STAMPS ONLY

PROVIDER’S NAME TELEPHONE NUMBER NEW AMOUNT PAID WHO PAYS EXPENSE HOW OFTEN PAID

- -

- -

I. CHILD SUPPORT EXPENSE: List any legally binding child support paid to NON-HOUSEHOLD members (includes current

payments, arrearages, and health insurance).

DEPENDENT’S NAME AMOUNT PAID HOW OFTEN PAID

1.

2.

3.

J. FOR TEMPORARY ASSISTANCE, PLEASE PROVIDE ANY INFORMATION THAT HAS CHANGED OR WAS NOT

PREVIOUSLY REPORTED ON THE ABSENT PARENT.

K. OTHER - PLEASE REPORT ANY OTHER CHANGES HERE: Examples: Change in medical insurance or coverage, a marriage or

divorce, ownership of property, etc. (Optional if Food Stamps only)

L. WILL THE CHANGE(S) BE FOR MORE THAN ONE MONTH? YES NO

IF YOU PURPOSELY HOLD BACK INFORMATION ABOUT CHANGES IN YOUR HOUSEHOLD, YOU WILL OWE US THE VALUE OF EXTRA BENEFITS YOU RECEIVE AS A

RESULT. YOU MAY ALSO BE BARRED FROM THE FOOD STAMP PROGRAM FOR 1 YEAR, 2 YEARS, OR PERMANENTLY AND BE FINED, AND/OR IMPRISONED.

PENALTY WARNING: Any information provided on this form is subject to verification by federal, state, and local officials. If any is inaccurate, you may be denied food stamp benefits

and/or be subject to criminal prosecution for knowingly providing false information.

13 CSR 40-2.190 provides for recovery of benefits when it is determined someone has received benefits they are not entitled to.

7 USC 2024(b)(c) and (h). Anyone who knowingly uses, transfers, acquires, alters or possesses coupons, or access devices in any manner contrary to the Food Stamp Act is subject to

fine and imprisonment. Upon conviction, punishments include a fine of $250,000 and/or imprisonment for 20 years if the value of the coupons or access devices is $5,000 or more. If the

value is less than $5,000 but greater than $100, punishments include a fine of $10,000 and/or imprisonment for 5 years. If the value is less than $100, punishments include a fine of

$1,000 and/or imprisonment for 1 year. Anyone who presents for payment or redemption coupons which have been illegally received, transferred, or used is subject to a fine of $20,000

and/or imprisonment for 5 years if the value of the coupons is $100 or more. If the value is less than $100, punishments include a fine of $1,000 and/or imprisonment for 1 year. Anyone

convicted of felony offenses relating to the above transactions is also subject to having all real and personal property used in such transactions forfeited to the United States.

7 USC 2015(b)(1). Anyone convicted in a federal, state or local court of trading benefits for controlled substances, illegal drugs or certain drugs for which a doctor’s prescription is

required, shall be barred from the Food Stamp Program for 2 years for the first offense and permanently for the second offense. Anyone convicted of trading benefits for firearms,

ammunition, or explosives is barred permanently from the Food Stamp Program for the first offense.

7 USC 2015(b)(1)(iii)(IV) and 2015 (j). Anyone convicted of trafficking in food stamp benefits of $500.00 or more shall be permanently disqualified from the Food Stamp Program for the

first offense. Anyone found by a state agency to have made or convicted in a federal or state court of having made fraudulent statements about identity or residence in order to receive

multiple food stamp benefits simultaneously shall be ineligible to participate in the Food Stamp Program for ten (10) years beginning with the date of such agency determination or such

conviction in a federal or state court.

I understand the penalty for hiding or giving false information. I also understand I will owe the value of any extra benefits I receive because I do not fully report changes in my household.

My signature below certifies under the penalty of perjury that all declarations made on this change report are true, accurate, and complete.

CLIENT SIGNATURE TELEPHONE NUMBER DATE

- -

MO 886-0417 (4-99)/E 04-2004 IM-145 (11/2021)

no reviews yet

Please Login to review.