220x Filetype PDF File size 0.41 MB Source: www.firstsentierinvestors.com.au

First Sentier Wholesale Future Leaders Fund

Formerly the Colonial First State Wholesale Future Leaders Fund

Quarterly Factsheet 30 June 2022

For Adviser use only

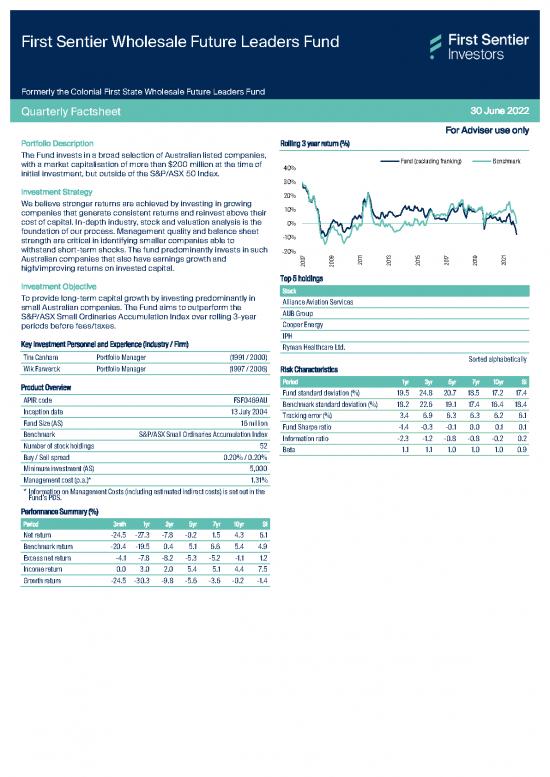

Portfolio Description Rolling 3 year return (%)

The Fund invests in a broad selection of Australian listed companies, Fund (excluding franking) Benchmark

with a market capitalisation of more than $200 million at the time of 40%

initial investment, but outside of the S&P/ASX 50 Index.

30%

Investment Strategy 20%

We believe stronger returns are achieved by investing in growing 10%

companies that generate consistent returns and reinvest above their

cost of capital. In-depth industry, stock and valuation analysis is the 0%

foundation of our process. Management quality and balance sheet -10%

strength are critical in identifying smaller companies able to

withstand short-term shocks. The fund predominantly invests in such -20% 7 9 11 13 15 17 9 21

Australian companies that also have earnings growth and 0 0 20 1

high/improving returns on invested capital. 20 20 20 20 20 20 20

Investment Objective Top 5 holdings

To provide long-term capital growth by investing predominantly in Stock

small Australian companies. The Fund aims to outperform the Alliance Aviation Services

S&P/ASX Small Ordinaries Accumulation Index over rolling 3-year AUB Group

periods before fees/taxes. Cooper Energy

IPH

Key Investment Personnel and Experience (Industry / Firm) Ryman Healthcare Ltd.

Tim Canham Portfolio Manager (1991 / 2000) Sorted alphabetically

Wik Farwerck Portfolio Manager (1997 / 2006) Risk Characteristics

Period 1yr 3yr 5yr 7yr 10yr SI

Product Overview Fund standard deviation (%) 19.5 24.8 20.7 18.5 17.2 17.4

APIR code FSF0469AU Benchmark standard deviation (%) 18.2 22.6 19.1 17.4 16.4 18.4

Inception date 13 July 2004 Tracking error (%) 3.4 6.9 6.3 6.3 6.2 6.1

Fund Size (A$) 16 million Fund Sharpe ratio -1.4 -0.3 -0.1 0.0 0.1 0.1

Benchmark S&P/ASX Small Ordinaries Accumulation Index Information ratio -2.3 -1.2 -0.8 -0.8 -0.2 0.2

Number of stock holdings 52 Beta 1.1 1.1 1.0 1.0 1.0 0.9

Buy / Sell spread 0.20% / 0.20%

Minimum investment (A$) 5,000

Management cost (p.a.)* 1.31%

* Information on Management Costs (including estimated indirect costs) is set out in the

Fund’s PDS.

Performance Summary (%)

Period 3mth 1yr 3yr 5yr 7yr 10yr SI

Net return -24.5 -27.3 -7.8 -0.2 1.5 4.3 6.1

Benchmark return -20.4 -19.5 0.4 5.1 6.6 5.4 4.9

Excess net return -4.1 -7.8 -8.2 -5.3 -5.2 -1.1 1.2

Income return 0.0 3.0 2.0 5.4 5.1 4.4 7.5

Growth return -24.5 -30.3 -9.8 -5.6 -3.6 -0.2 -1.4

First Sentier Wholesale Future Leaders Fund 30 June 2022

Growth of AUD 10,000 Investment Since Inception Distributions

$0.08

Fund Benchmark

$50,000 $0.07

$40,000 $0.06

$0.05

$30,000 $0.04

$20,000 $0.03

$0.02

$10,000 $0.01

$0 $0.00

2004 2007 2010 2013 2016 2019 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Sep-20 Sep-21

Top 5 contributors to performance (3 months) Top 5 detractors to performance (3 months)

Sector Value added Sector Value added

Real Estate -0.57% Materials -9.13%

Health Care -0.87% Consumer Discretionary -3.33%

Energy -1.44% Industrials -2.89%

Communication Services -1.56% Information Technology -2.66%

Financials -1.85% Financials -1.85%

Performance returns are calculated net of management fees and transaction costs. Performance returns for periods greater than one year are annualised. Past performance is not a

reliable indicator of future performance.

Data source: First Sentier Investors 2022

Data as at: 30 June 2022

First Sentier Future Leaders Fund

June 2022 quarterly review

Fund activity and performance

The First Sentier Future Leaders Fund fell 25.0% in the quarter vs the ASX S&P Small Ordinaries fall of 20.3%. Strong performance from

healthcare and defensive companies underpinned positive performers of the Fund. An underweight position in coal and weakness in select

mining/IT exposures were negative for the Fund in the quarter.

Positive contributors for the quarter included:

IPH - positive share price performance reflects the market’s regard for the defensive characteristics of its earnings from its intellectual

property filing business. Their Asian business should be a key driver of growth while their Australian and New Zealand business is expected

to provide relatively stable earnings, at the same time benefitting from margin expansion due to the integration of acquisitions.

Alliance Aviation – rallied on the announcement of the entrance into a Scheme of Implementation deed to be acquired by Qantas for

$4.75/share, a 32% premium to the VWAP over the last 3 months.

Ryman Healthcare – performed strongly on the backdrop of a strong FY22 result with profit growth ahead of consensus at 14%. They also

indicated that their build rate will increase to c1000+ units in FY23, a material step up from 706, and suggested a further increase to resale

prices.

Dalrymple Bay Infrastructure – benefitted from its defensive characteristics as the holder of an industrial 99-year lease to the Dalrymple Bay

Coal terminal. Potential for increased toll charges to customers remains unresolved with any increase to be backdated to 1 July 2021. This

could allow an increase in distributions to shareholders.

Incitec Pivot – released a strong 1H22 result reflecting high fertiliser prices, strong explosive volumes and improved manufacturing

performance. They also announced they intend to demerge its explosive and fertiliser business to create two separate listed companies on

the ASX.

Negative contributors for the quarter

First Sentier Wholesale Future Leaders Fund 30 June 2022

Eroad – declined amidst a broader sell-off in technology names and as they released a soft FY22 result with the market focusing on the wide

range of FY23 earnings guidance and step up in operating expenses. Eroad provided an optimistic organic revenue FY25 target of $250m

which is indicative of management’s confidence in converting their pipeline of opportunities and driving unit growth.

Aurelia Metals - declined as gold and copper prices softened over the quarter and after reporting a weak March quarter due to weather

disruptions and weaker grades. However these are likely to be short term impacts and the long term outlook remains positive with the large

pipeline of opportunities at Federation and at Great Cobar with recent results confirming large intersections of copper and gold.

HT&E – continues to experience weakness as the market factors in advertising spend weakness as the economy slows. They remain the

market leading radio broadcaster and the acquisition of Grant Broadcasters further expands their market share. Despite the common

misconception that radio is on a structural decline, national weekly listenership continues to increase highlighting the habitual nature of radio

listeners. Further HT&Es investment into podcasting content also provides an offset to any decline.

Chrysos – declined as technology companies were sold-off as interest rates rose. Chrysos offers a superior solution for gold assaying using

its PhotonAssay Technology, and its long term earnings trajectory is attractive given the large addressable market and strong unit economics

with recent units delivering a ~43% ROIC.

Silver Lake Resources– declined as they withdrew FY22 guidance because of disruptions caused by Covid-19 related labour shortages and

supply chain disruptions. Nonetheless, expectations are that any miss to previous guidance should not be material.

Fund activity

During the quarter the fund added or increased the following positions:

Carsales – the Fund switched is investment in Domain Holdings to Carsales in the quarter. The relative defensive nature of Carsales and

continued buoyancy in both used and new car sales underpins the investment. Carsales also trades at a relatively lower multiple versus

consumer IT related names.

Boss Resources – Boss completed the funding for the re-start of the Honeymoon Well uranium project in South Australia. A global resurgence

of nuclear energy is gaining traction as zero-emission base load power sources are sought. The company also has a strategic investment in

physical uranium stored in the USA.

Hub24 – a recent sell-off in the company has prompted a re-visit of the investment platform name. Solid flows spread across a range of asset

classes and exposure to rising interest rates makes HUB relatively more attractive than pure fund managers in a weak equity market.

Audinate – Audinate continues to recover from the lock-downs imposed on its key customers, namely users of audio products in conventions

centres, education and stadiums. The company’s core audio chip product Dante remains the industry leader, with relatively scarce

competition. Audinate enters FY23 with a solid order book of sales.

Ryman – the Fund took the opportunity to increase its holding on weakness in the aged care/retirement sector. This has mainly been

prompted by the potential weakness in the housing market. In past cycles this has proven to not dampen demand as Rymans services remain

a ‘need’ not a ‘want’. The company’s earnings remain very defensive in aged care and is underpinned by a large bank of profits from units

acquired 7-10 years prior.

Cooper Energy – after a difficult period with processing plant issues from partner APA, Cooper finally took the bold decision to acquire the

plant and associated infrastructure via a $244m capital raising. This gives the company much greater exposure to very high East Coast gas

prices, near $40 G/J. The benefits should be significant to Cooper if plant availability improves and production growth plans can be realised

First Sentier Wholesale Future Leaders Fund 30 June 2022

During the quarter the Fund reduced/exited positions in the following:

Domain Holdings – a high multiple and potential weakness in property volumes saw the Fund exit the position. A switch as made into

Carsales.com.

Megaport – the company has been hit hard by the sell-off in tech, but also from relatively weak sales results. With such a high implied

valuation and cash-burn still evident, the Fund opted to exit the position.

IDP Education – taking profits on recovery in the stock from 2021 lows but also on view of potential visa disruptions as international students

return en masse.

Ramelius Resources – a consistent cash generator but with a heightened capex profile better value and lower risk was seen elsewhere in the

sector.

Tyro – continued underperformance of the trading volumes and a very high multiple saw the Fund exit the position. Subsequent to the Fund

exiting, the CEO resigned suddenly.

Fund positioning and outlook

Fears of continued rapid inflation and global banks looking increasingly “behind the curve’ has further rattled both bond and equity markets.

The May headline US CPI came in higher than expected, increasing 1.0% m/m and 8.6% y/y, the biggest annual increase since late 1981.

Rising energy prices have continued to cause concern as they have underpinned cost of living pressures for consumers namely via food,

petrol and power/heating costs. Equity markets remain in a dilemma over the likelihood of a global recession.

While equity prices have corrected in 2022, this has mainly come from PE multiple compression. The next step will be the extent of the

downward revisions to company earnings. The extent of margin pressure and headwinds from the strong USD will be keenly watched in the

upcoming US quarterly earnings season.

The US dollar has moved fast and higher

High oil and gas prices have exacerbated pressure on margins and cost of living pressures. Clearly lack of investment in energy production

and refining both due to low prices and government policy have been problematic.

no reviews yet

Please Login to review.