Authentication

271x Tipe XLS Ukuran file 0.16 MB Source: www.ojk.go.id

Sheet 1: Neraca

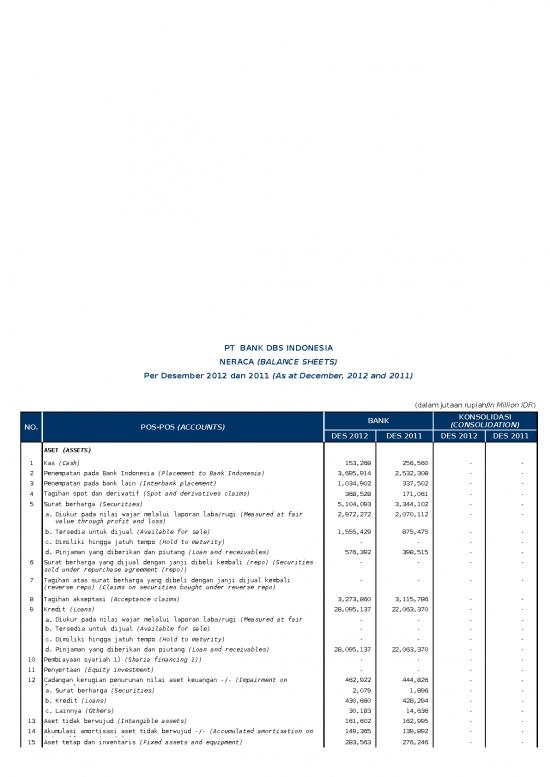

| PT BANK DBS INDONESIA | ||||||

| NERACA (BALANCE SHEETS) | ||||||

| Per Desember 2012 dan 2011 (As at December, 2012 and 2011) | ||||||

| (dalam jutaan rupiah/In Million IDR) | ||||||

| NO. | POS-POS (ACCOUNTS) | BANK | KONSOLIDASI (CONSOLIDATION) | |||

| DES 2012 | DES 2011 | DES 2012 | DES 2011 | |||

| ASET (ASSETS) | ||||||

| 1 | Kas (Cash) | 153,268 | 256,560 | - | - | |

| 2 | Penempatan pada Bank Indonesia (Placement to Bank Indonesia) | 3,695,914 | 2,532,308 | - | - | |

| 3 | Penempatan pada bank lain (Interbank placement) | 1,034,902 | 337,502 | - | - | |

| 4 | Tagihan spot dan derivatif (Spot and derivatives claims) | 368,528 | 171,061 | - | - | |

| 5 | Surat berharga (Securities) | 5,104,093 | 3,344,102 | - | - | |

| a. | Diukur pada nilai wajar melalui laporan laba/rugi (Measured at fair value through profit and loss) | 2,972,272 | 2,070,112 | - | - | |

| b. | Tersedia untuk dijual (Available for sale) | 1,555,429 | 875,475 | - | - | |

| c. | Dimiliki hingga jatuh tempo (Hold to maturity) | - | - | - | - | |

| d. | Pinjaman yang diberikan dan piutang (Loan and receivables) | 576,392 | 398,515 | - | - | |

| 6 | Surat berharga yang dijual dengan janji dibeli kembali (repo) (Securities sold under repurchase agreement (repo)) | - | - | - | - | |

| 7 | Tagihan atas surat berharga yang dibeli dengan janji dijual kembali (reverse repo) (Claims on securities bought under reverse repo) | - | - | - | - | |

| 8 | Tagihan akseptasi (Acceptance claims) | 3,273,860 | 3,115,786 | - | - | |

| 9 | Kredit (Loans) | 28,095,137 | 22,063,370 | - | - | |

| a. | Diukur pada nilai wajar melalui laporan laba/rugi (Measured at fair value through profit and loss) | - | - | - | - | |

| b. | Tersedia untuk dijual (Available for sale) | - | - | - | - | |

| c. | Dimiliki hingga jatuh tempo (Hold to maturity) | - | - | - | - | |

| d. | Pinjaman yang diberikan dan piutang (Loan and receivables) | 28,095,137 | 22,063,370 | - | - | |

| 10 | Pembiayaan syariah 1) (Sharia financing 1)) | - | - | - | - | |

| 11 | Penyertaan (Equity investment) | - | - | - | - | |

| 12 | Cadangan kerugian penurunan nilai aset keuangan -/- (Impairment on financial assets -/-) | 462,922 | 444,826 | - | - | |

| a. | Surat berharga (Securities) | 2,079 | 1,896 | - | - | |

| b. | Kredit (Loans) | 430,660 | 428,294 | - | - | |

| c. | Lainnya (Others) | 30,183 | 14,636 | - | - | |

| 13 | Aset tidak berwujud (Intangible assets) | 161,602 | 162,995 | - | - | |

| 14 | Akumulasi amortisasi aset tidak berwujud -/- (Accumulated amortisation on intangible assets -/-) | 149,365 | 139,892 | - | - | |

| 15 | Aset tetap dan inventaris (Fixed assets and equipment) | 283,563 | 276,246 | - | - | |

| 16 | Akumulasi penyusutan aset tetap dan inventaris -/- (Accumulated depreciation on fixed assets and equipment -/-) | 251,228 | 208,407 | - | - | |

| 17 | Aset non produktif (Non Productive Asset) | - | 7,185 | - | - | |

| a. | Properti terbengkalai (Abandoned property) | - | - | - | - | |

| b. | Aset yang diambil alih (Foreclosed assets) | - | - | - | - | |

| c. | Rekening tunda (Suspense accounts) | - | 7,185 | - | - | |

| d. | Aset antarkantor 2) (Interbranch assets) | - | - | - | - | |

| i. Melakukan kegiatan operasional di Indonesia (Conducting operational activities in Indonesia) | - | - | - | - | ||

| ii. Melakukan kegiatan operasional di luar Indonesia (Conducting operational activities outside Indonesia) | - | - | - | - | ||

| 18 | Cadangan kerugian penurunan nilai dari aset non keuangan -/- (Imparment on Non Financial Assets -/-) | - | - | - | - | |

| 19 | Sewa pembiayaan 3) (Leasing 3)) | - | - | - | - | |

| 20 | Aset pajak tangguhan (Deferred tax assets) | 33,070 | 3,806 | - | - | |

| 21 | Aset Lainnya (Other assets) | 348,237 | 1,004,504 | - | - | |

| TOTAL ASET (TOTAL ASSETS) | 41,688,659 | 32,482,300 | - | - | ||

| LIABILITAS DAN EKUITAS (LIABILITIES AND EQUITIES) | ||||||

| LIABILITAS (LIABILITIES) | - | - | - | - | ||

| 1 | Giro (Current account) | 5,881,491 | 5,273,545 | - | - | |

| 2 | Tabungan (Saving account) | 1,422,522 | 1,575,449 | - | - | |

| 3 | Simpanan berjangka (Time deposit) | 21,870,864 | 14,978,103 | - | - | |

| 4 | Dana investasi revenue sharing 1) (Revenue sharing investment 1)) | - | - | - | - | |

| 5 | Pinjaman dari Bank Indonesia (Liabilities to Bank Indonesia) | - | - | - | - | |

| 6 | Pinjaman dari bank lain (Interbank liabilities) | 3,221,428 | 2,843,465 | - | - | |

| 7 | Liabilitas spot dan derivatif (Spot and derivatives liabilities) | 114,645 | 92,086 | - | - | |

| 8 | Utang atas surat berharga yang dijual dengan janji dibeli kembali (repo) (Liabilities on securities sold under repurchase agreement) | - | - | - | - | |

| 9 | Utang akseptasi (Acceptance liabilities) | 3,197,064 | 2,832,033 | - | - | |

| 10 | Surat berharga yang diterbitkan (Issued securities) | - | - | - | - | |

| 11 | Pinjaman yang diterima (Loans received) | 965,722 | 270 | - | - | |

| a. | Pinjaman yang dapat diperhitungkan sebagai modal (Loans calculated as capital) | - | - | - | - | |

| b. | Pinjaman yang diterima lainnya (Other loans received) | 965,722 | 270 | - | - | |

| 12 | Setoran jaminan (Margin deposit) | 9,479 | - | - | - | |

| 13 | Liabilitas antarkantor 2) (Interbranch liabilities) | - | - | - | - | |

| a. | Melakukan kegiatan operasional di Indonesia (Conducting operational activities in Indonesia) | - | - | - | - | |

| b. | Melakukan kegiatan operasional di luar Indonesia (Conducting operational activities outside Indonesia) | - | - | - | - | |

| 14 | Liabilitas pajak tangguhan (Deferred tax liabilities) | - | - | - | - | |

| 15 | Liabilitas lainnya (Other liabilities) | 627,094 | 1,110,483 | - | - | |

| 16 | Dana investasi profit sharing 1) (Profit Sharing investment 1)) | - | - | - | - | |

| TOTAL LIABILITAS (TOTAL LIABILITIES) | 37,310,309 | 28,705,434 | - | - | ||

| EKUITAS (EQUITIES) | - | - | - | - | ||

| 1 | Modal disetor (Paid in capital) | 2,225,000 | 2,225,000 | - | - | |

| a. | Modal dasar (Capital) | 3,000,000 | 3,000,000 | - | - | |

| b. | Modal yang belum disetor -/- (Unpaid capital -/-) | 775,000 | 775,000 | - | - | |

| c. | Saham yang dibeli kembali (treasury stock) -/- (Treasury stock -/-) | - | - | - | - | |

| 2 | Tambahan modal disetor (Additional paid in capital) | - | - | - | - | |

| a. | Agio (Agio) | - | - | - | - | |

| b. | Disagio -/- (Disagio -/-) | - | - | - | - | |

| c. | Modal sumbangan (Donated capital) | - | - | - | - | |

| d. | Dana setoran modal (Fund for paid up capital) | - | - | - | - | |

| e. | Lainnya (Others) | - | - | - | - | |

| 3 | Pendapatan (kerugian) komprehensif lainnya (Other comprehensive gain (loss)) | 4,174 | 20,751 | - | - | |

| a. | Penyesuaian akibat penjabaran laporan keuangan dalam mata uang asing (Translation adjustment from foreign currency) | - | - | - | - | |

| b. | Keuntungan(kerugian) dari perubahan nilai aset keuangan dalam kelompok tersedia untuk dijual (Gain (loss) on value changes of financial assets categorized as available for sale) | 14,410 | 20,679 | - | - | |

| c. | Bagian efektif lindung nilai arus kas (Effective portion of cash flow hedge) | - | - | - | - | |

| d. | Selisih penilaian kembali aset tetap (Difference in fixed asset revaluation) | - | - | - | - | |

| e. | Bagian pendapatan komprehensif lain dari entitas asosiasi (Portion of other comprehensive income from associates) | - | - | - | - | |

| f. | Keuntungan (kerugian) aktuarial program manfaat pasti (Gain (loss) on defined benefit actuarial program) | (8,845) | - | - | - | |

| g. | Pajak penghasilan terkait dengan laba komprehensif lain (Income tax of other comprehensive income) | (1,391) | 72 | - | - | |

| h. | Lainnya (Others) | - | - | - | - | |

| 4 | Selisih kuasi reorganisasi 4) (Difference in quasi-reorganization 4)) | - | - | - | - | |

| 5 | Selisih restrukturisasi entitas sepengendali 5) (Difference in restructuring under common control 5)) | - | - | - | - | |

| 6 | Ekuitas Lainnya (Other Equity) | - | - | - | - | |

| 7 | Cadangan (Reserves) | - | - | - | - | |

| a. | Cadangan umum (General reserves) | - | - | - | - | |

| b. | Cadangan tujuan (Appropriated reserves) | - | - | - | - | |

| 8 | Laba/rugi (Gain/loss) | 2,149,176 | 1,531,115 | - | - | |

| a. | Tahun-tahun lalu (Previous years) | 1,531,115 | 1,147,159 | - | - | |

| b. | Tahun berjalan (Current year) | 618,061 | 383,956 | - | - | |

| TOTAL EKUITAS YANG DAPAT DIATRIBUSIKAN KEPADA PEMILIK (TOTAL EQUITIES ATTRIBUTABLE TO OWNERS) | 4,378,350 | 3,776,866 | - | - | ||

| 9 | Kepentingan non pengendali 6) (Minority interest 6)) | - | - | - | - | |

| TOTAL EKUITAS (TOTAL EQUITIES) | 4,378,350 | 3,776,866 | - | - | ||

| TOTAL LIABILITAS DAN EKUITAS (TOTAL LIABILITIES AND EQUITIES) | 41,688,659 | 32,482,300 | - | - | ||

| PT BANK DBS INDONESIA | ||||||

| LAPORAN LABA-RUGI (INCOME STATEMENTS) | ||||||

| Per Desember 2012 dan 2011 (As at December, 2012 and 2011) | ||||||

| (dalam jutaan rupiah/In Million IDR) | ||||||

| NO. | POS-POS (ACCOUNTS) | BANK | KONSOLIDASI (CONSOLIDATION) | |||

| DES 2012 | DES 2011 | DES 2012 | DES 2011 | |||

| PENDAPATAN DAN BEBAN OPERASIONAL (OPERATIONAL INCOME AND EXPENSES) | ||||||

| A. | Pendapatan dan Beban Bunga (Interest income and expenses) | - | - | - | - | |

| 1. | Pendapatan Bunga (Interest income) | 2,460,620 | 1,936,389 | - | - | |

| a. | Rupiah (Rupiah) | 1,801,921 | 1,539,962 | - | - | |

| b. | Valuta Asing (Foreign currency) | 658,699 | 396,427 | - | - | |

| 2. | Beban Bunga (Interest expenses) | 1,122,133 | 928,998 | - | - | |

| a. | Rupiah (Rupiah) | 917,205 | 857,916 | - | - | |

| b. | Valuta Asing (Foreign currency) | 204,928 | 71,082 | - | - | |

| Pendapatan (Beban) Bunga bersih (Net interest income (expenses)) | 1,338,487 | 1,007,391 | - | - | ||

| B. | Pendapatan dan Beban Operasional selain Bunga (Operational Income and Expenses Other than Interest) | |||||

| 1. | Pendapatan Operasional Selain Bunga (Operational Income Other than Interest) | 811,931 | 681,260 | - | - | |

| a. | Peningkatan nilai wajar aset keuangan (Positive mark to market on financial assets) | 196,290 | 185,331 | - | - | |

| i. Surat berharga (Securities) | 15,562 | 14,270 | - | - | ||

| ii. Kredit (Loans) | - | - | - | - | ||

| iii. Spot dan derivatif (Spot and derivatives) | 180,728 | 171,061 | - | - | ||

| iv. Aset keuangan lainnya (Other financial assets) | - | - | - | - | ||

| b. | Penurunan nilai wajar liabilitas keuangan (Negative mark to market on financial liabilities) | - | - | - | - | |

| c. | Keuntungan penjualan aset keuangan (Gain on sale of financial assets) | 149,902 | 171,555 | - | - | |

| i. Surat berharga (Securities) | 149,902 | 171,555 | - | - | ||

| ii. Kredit (Loans) | - | - | - | - | ||

| iii. Aset keuangan lainnya (Other financial assets) | - | - | - | - | ||

| d. | Keuntungan transaksi spot dan derivatif (realised) (Gain on spot and derivatives (realised)) | 155,309 | 6,452 | - | - | |

| e. | Keuntungan dari penyertaan dengan equity method (Gain on investment under equity method) | - | - | - | - | |

| f. | Dividen (Dividend) | - | - | - | - | |

| g. | komisi/provisi/fee dan administrasi (Comission/provision/fee and administration) | 300,177 | 247,966 | - | - | |

| h. | Pemulihan atas cadangan kerugian penurunan nilai (Recovery of asset impairment) | 4,008 | 66,715 | - | - | |

| i. | Pendapatan lainnya (Other income) | 6,245 | 3,241 | - | - | |

| 2. | Beban Operasional Selain Bunga (Operational Expenses Other than Interest) | 1,470,869 | 1,522,964 | - | - | |

| a. | Penurunan nilai wajar aset keuangan (Negative mark to market on financial assets) | 247,254 | 102,058 | - | - | |

| i. Surat berharga (Securities) | 21,235 | 9,972 | - | - | ||

| ii. Kredit (Loans) | - | - | - | - | ||

| iii. Spot dan derivatif (Spot and derivatives) | 226,019 | 92,086 | - | - | ||

| iv. Aset keuangan lainnya (Other financial assets) | - | - | - | - | ||

| b. | Peningkatan nilai wajar liabilitas keuangan (Positive mark to market on financial liabilities) | - | - | - | - | |

| c. | Kerugian penjualan aset keuangan (Loss on sale of financial assets) | 14 | 953 | - | - | |

| i. Surat berharga (Securities) | 14 | 953 | - | - | ||

| ii. Kredit (Loans) | - | - | - | - | ||

| iii. Aset keuangan lainnya (Other financial assets) | - | - | - | - | ||

| d. | Kerugian transaksi spot dan derivatif (realised) (Loss on spot and derivatives (realised)) | 93,089 | 284,433 | - | - | |

| e. | Kerugian penurunan nilai aset keuangan (impairment) (Impairment of financial assets) | 118,352 | 204,570 | - | - | |

| i. Surat berharga (Securities) | 311 | 549 | - | - | ||

| ii. Kredit (Loans) | 99,922 | 196,125 | - | - | ||

| iii. Pembiayaan syariah (Sharia financing) | - | - | - | - | ||

| iv. Aset keuangan lainnya (Other financial assets) | 18,119 | 7,896 | - | - | ||

| f. | Kerugian terkait risiko operasional *) (Losses on operational risk *)) | 542 | 154 | - | - | |

| g. | Kerugian dari penyertaan dengan equity method (Losses on investment under equity method) | - | - | - | - | |

| h. | Komisi/provisi/fee dan administrasi (Commission/provision/fee, and administration) | 117,121 | 72,964 | - | - | |

| i. | Kerugian penurunan nilai aset lainnya (non keuangan) (Impairment of other assets (non financial assets)) | - | - | - | - | |

| j. | Beban tenaga kerja (Personnel expenses) | 465,280 | 404,079 | - | - | |

| k. | Beban promosi (Promotion expenses) | 24,477 | 34,161 | - | - | |

| l. | Beban lainnya (Other expenses) | 404,740 | 419,592 | - | - | |

| Pendapatan (Beban) Operasional Selain Bunga Bersih (Net Operational Income (Expenses) Other than Interest ) | (658,938) | (841,704) | - | - | ||

| LABA (RUGI) OPERASIONAL (OPERATIONAL PROFIT (LOSS)) | 679,549 | 165,687 | - | - | ||

| PENDAPATAN DAN (BEBAN) NON OPERASIONAL (NON OPERATIONAL INCOME (EXPENSES) ) | ||||||

| 1. | Keuntungan (kerugian) penjualan aset tetap dan inventaris (Gain (loss) on sale of fixed assets and equipment) | (168) | 3,064 | - | - | |

| 2. | Keuntungan (kerugian) penjabaran transaksi valuta asing (Gain (loss) on foreign exchange translation ) | 151,656 | 352,029 | - | - | |

| 3. | Pendapatan (beban) non operasional lainnya (Other non operational income (expenses) ) | 18 | (735) | - | - | |

| LABA (RUGI) NON OPERASIONAL (NON OPERATIONAL PROFIT (LOSS)) | 151,506 | 354,358 | - | - | ||

| LABA (RUGI) TAHUN BERJALAN SEBELUM PAJAK (CURRENT YEAR PROFIT (LOSS)) | 831,055 | 520,045 | - | - | ||

| 4. | Pajak Penghasilan (Income taxes) | 212,994 | 136,089 | - | - | |

| a. | Taksiran pajak tahun berjalan (Estimated current year tax) | 243,721 | 116,654 | - | - | |

| b. | Pendapatan (beban) pajak tangguhan (Deferred tax income (expenses)) | 30,727 | (19,435) | - | - | |

| LABA (RUGI) TAHUN BERJALAN SETELAH PAJAK BERSIH (NET PROFIT (LOSS)) | 618,061 | 383,956 | - | - | ||

| PENDAPATAN KOMPREHENSIF LAIN (OTHER COMPREHENSIVE INCOME) | (15,114) | 7,691 | - | - | ||

| a. | Penyesuaian akibat penjabaran laporan keuangan dalam mata uang asing (Translation adjustment from foreign currency) | - | - | - | - | |

| b. | Keuntungan (kerugian) dari perubahan nilai aset keuangan dalam kelompok tersedia untuk dijual (Gain (loss) on value changes of financial assets categorized as available for sale ) | (6,269) | 7,691 | - | - | |

| c. | Bagian efektif dari lindung nilai arus kas (Effective portion of cash flow hedge) | - | - | - | - | |

| d. | Keuntungan revaluasi aset tetap (Gain on fixed asset revaluation) | - | - | - | - | |

| e. | Bagian pendapatan komprehensif lain dari entitas asosiasi (Portion of other comprehensive income from associates) | - | - | - | - | |

| f. | Keuntungan (kerugian) aktuarial program manfaat pasti (Gain (loss) on defined benefit actuarial program) | (8,845) | - | - | - | |

| g. | penghasilan terkait dengan laba komprehensif lain(-/-) (Income tax of other comprehensive income(-/-)) | 1,463 | (3,317) | - | - | |

| h. | Lainnya (Others) | - | - | - | - | |

| Pendapatan Komprehensif lain tahun berjalan - net pajak penghasilan terkait (Other comprehensive income of the current year - net of applicable income tax) | (16,577) | 11,008 | - | - | ||

| TOTAL LABA KOMPREHENSIF TAHUN BERJALAN (CURRENT YEAR TOTAL COMPREHENSIVE PROFIT) | 601,484 | 394,964 | - | - | ||

| LABA YANG DAPAT DIATRIBUSIKAN KEPADA (PROFIT ATTRIBUTABLE TO): | ||||||

| a. | PEMILIK (OWNER) | 618,061 | 383,956 | - | - | |

| b. | KEPENTINGAN NON PENGENDALI (MINORITY INTEREST) | - | - | - | - | |

| TOTAL LABA TAHUN BERJALAN (CURRENT YEAR TOTAL PROFIT) | 618,061 | 383,956 | - | - | ||

| TOTAL LABA KOMPREHENSIF YANG DAPAT DIATRIBUSIKAN KEPADA (TOTAL COMPREHENSIVE PROFIT ATTRIBUTABLE TO): | ||||||

| a. | PEMILIK (OWNER) | 601,484 | 394,964 | - | - | |

| b. | KEPENTINGAN NON PENGENDALI (MINORITY INTEREST) | - | - | - | - | |

| TOTAL LABA KOMPREHENSIF TAHUN BERJALAN (CURRENT YEAR TOTAL COMPREHENSIVE PROFIT) | 601,484 | 394,964 | - | - | ||

| TRANSFER LABA (RUGI) KE KANTOR PUSAT **) (TRANSFER OF PROFIT(LOSS) TO HEAD OFFICE) | - | - | - | - | ||

| DIVIDEN (DIVIDEND) | - | - | - | - | ||

| LABA BERSIH PER SAHAM ***) (NET EARNINGS (LOSS) PER SHARE ***)) | - | - | - | - | ||

| PT BANK DBS INDONESIA | ||||||

| LAPORAN KOMITMEN DAN KONTIJENSI (COMMITMENTS AND CONTINGENCIES STATEMENTS) | ||||||

| Per Desember 2012 dan 2011 (As at December, 2012 and 2011) | ||||||

| (dalam jutaan rupiah/In Million IDR) | ||||||

| NO. | POS-POS (ACCOUNTS) | BANK | KONSOLIDASI (CONSOLIDATION) | |||

| DES 2012 | DES 2011 | DES 2012 | DES 2011 | |||

| I | TAGIHAN KOMITMEN (COMMITTED CLAIMS) | 2,585,002 | 3,354,124 | - | - | |

| 1. | Fasilitas pinjaman yang belum ditarik (Unused borrowing) | 963,750 | 1,813,500 | - | - | |

| a. | Rupiah (Rupiah) | - | - | - | - | |

| b. | Valuta Asing (Foreign currency) | 963,750 | 1,813,500 | - | - | |

| 2. | Posisi pembelian spot dan derivatif yang masih berjalan (Outstanding spot and derivatives (purchased)) | 1,621,252 | 1,540,624 | - | - | |

| 3. | Lainnya (Others) | - | - | - | - | |

| II | KEWAJIBAN KOMITMEN (COMMITED LIABILITIES) | 46,960,809 | 37,001,532 | - | - | |

| 1. | Fasilitas kredit kepada nasabah yang belum ditarik (Undisbursed loan facilities to debtors) | 42,967,588 | 34,085,036 | - | - | |

| a. | BUMN (BUMN) | 7,434,032 | 4,292,616 | - | - | |

| i. Committed (Committed) | 470,023 | 216,932 | - | - | ||

| - Rupiah (Rupiah) | 470,023 | 55,675 | - | - | ||

| - Valuta Asing (Foreign Currency) | - | 161,257 | - | - | ||

| ii. Uncommitted (Uncommitted ) | 6,964,009 | 4,075,684 | - | - | ||

| - Rupiah (Rupiah) | 1,630,553 | 420,121 | - | - | ||

| - Valuta Asing (Foreign Currency) | 5,333,456 | 3,655,563 | - | - | ||

| b. | Lainnya (Others) | 35,533,556 | 29,792,420 | - | - | |

| i. Committed (Committed ) | 3,142,812 | 2,661,314 | - | - | ||

| ii. Uncommitted (Uncommitted) | 32,390,744 | 27,131,106 | - | - | ||

| 2. | Fasilitas kredit kepada bank lain yang belum ditarik (Undisbursed loan facilities to other banks) | - | - | - | - | |

| a. | Committed (Committed) | - | - | - | - | |

| - Rupiah (Rupiah) | - | - | - | - | ||

| - Valuta Asing (Foreign Currency) | - | - | - | - | ||

| b. | Uncommitted (Uncommitted ) | - | - | - | - | |

| - Rupiah (Rupiah) | - | - | - | - | ||

| - Valuta Asing (Foreign Currency) | - | - | - | - | ||

| 3. | Irrevocable L/C yang masih berjalan (Outstanding irrevocable L/C ) | 1,958,358 | 1,726,884 | - | - | |

| a. | L/C luar negeri (Foreign L/C) | 1,382,150 | 1,401,220 | - | - | |

| b. | L/C dalam negeri (Local L/C) | 576,208 | 325,664 | - | - | |

| 4. | Posisi penjualan spot dan derivatif yang masih berjalan (Outstanding spot and derivatives (sold)) | 2,034,863 | 1,189,612 | - | - | |

| 5. | Lainnya (Others) | - | - | - | - | |

| III | TAGIHAN KONTINJENSI (CONTINGENT CLAIMS) | 8,578,171 | 3,957,281 | - | - | |

| 1. | Garansi yang diterima (Received guarantees) | 8,507,620 | 3,918,239 | - | - | |

| a. | Rupiah (Rupiah) | 3,543,266 | 1,220,699 | - | - | |

| b. | Valuta Asing (Foreign currency) | 4,964,354 | 2,697,540 | - | - | |

| 2. | Pendapatan bunga dalam penyelesaian (Accrued interest) | 70,551 | 39,042 | - | - | |

| a. | Bunga kredit yang diberikan (Loan interest) | 70,551 | 39,042 | - | - | |

| b. | Bunga lainnya (Other interest) | - | - | - | - | |

| 3. | Lainnya (Others) | - | - | - | - | |

| IV | KEWAJIBAN KONTINJENSI (CONTINGENT LIABILITIES) | 2,484,424 | 1,606,027 | - | - | |

| 1. | Garansi yang diberikan (Issued guarantees) | 2,484,424 | 1,606,027 | - | - | |

| a. | Rupiah (Rupiah) | 687,902 | 367,565 | - | - | |

| b. | Valuta Asing (Foreign currency) | 1,796,522 | 1,238,462 | - | - | |

| 2. | Lainnya (Others) | - | - | - | - | |

no reviews yet

Please Login to review.