142x Filetype PDF File size 0.08 MB Source: www.irs.gov

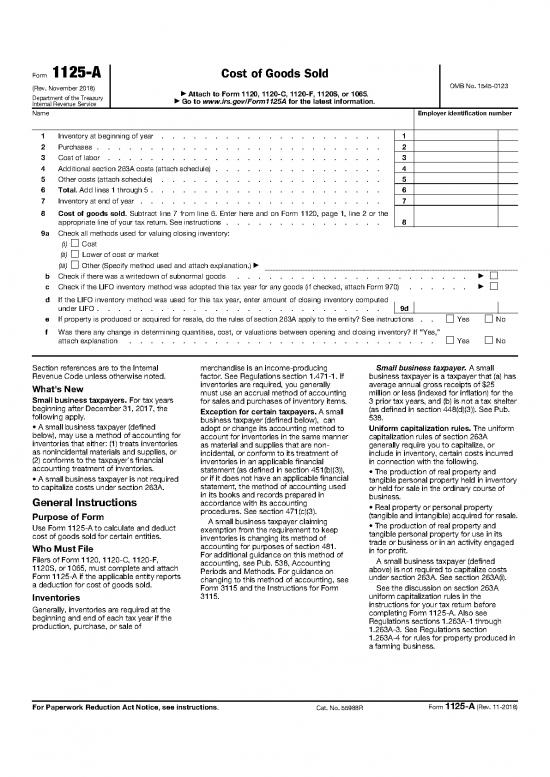

Form 1125-A Cost of Goods Sold

(Rev. November 2018) OMB No. 1545-0123

Department of the Treasury ▶ Attach to Form 1120, 1120-C, 1120-F, 1120S, or 1065.

▶

Internal Revenue Service Go to www.irs.gov/Form1125A for the latest information.

Name Employer identification number

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . 1

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Additional section 263A costs (attach schedule) . . . . . . . . . . . . . . . . 4

5 Other costs (attach schedule) . . . . . . . . . . . . . . . . . . . . . 5

6 Total. Add lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . 6

7 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . 7

8 Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or the

appropriate line of your tax return. See instructions . . . . . . . . . . . . . . . 8

9a Check all methods used for valuing closing inventory:

(i) Cost

(ii) Lower of cost or market

▶

(iii) Other (Specify method used and attach explanation.)

▶

b Check if there was a writedown of subnormal goods . . . . . . . . . . . . . . . . . . . . . .

▶

c Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970) . . . . . .

d If the LIFO inventory method was used for this tax year, enter amount of closing inventory computed

under LIFO . . . . . . . . . . . . . . . . . . . . . . . . . . . 9d

e If property is produced or acquired for resale, do the rules of section 263A apply to the entity? See instructions . . Yes No

f Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If “Yes,”

attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

Section references are to the Internal merchandise is an income-producing Small business taxpayer. A small

Revenue Code unless otherwise noted. factor. See Regulations section 1.471-1. If business taxpayer is a taxpayer that (a) has

What's New inventories are required, you generally average annual gross receipts of $25

must use an accrual method of accounting million or less (indexed for inflation) for the

Small business taxpayers. For tax years for sales and purchases of inventory items. 3 prior tax years, and (b) is not a tax shelter

beginning after December 31, 2017, the Exception for certain taxpayers. A small (as defined in section 448(d)(3)). See Pub.

following apply. business taxpayer (defined below), can 538.

• A small business taxpayer (defined adopt or change its accounting method to Uniform capitalization rules. The uniform

below), may use a method of accounting for account for inventories in the same manner capitalization rules of section 263A

inventories that either: (1) treats inventories as material and supplies that are non- generally require you to capitalize, or

as nonincidental materials and supplies, or incidental, or conform to its treatment of include in inventory, certain costs incurred

(2) conforms to the taxpayer's financial inventories in an applicable financial in connection with the following.

accounting treatment of inventories. statement (as defined in section 451(b)(3)), • The production of real property and

• A small business taxpayer is not required or if it does not have an applicable financial tangible personal property held in inventory

to capitalize costs under section 263A. statement, the method of accounting used or held for sale in the ordinary course of

in its books and records prepared in business.

General Instructions accordance with its accounting • Real property or personal property

Purpose of Form procedures. See section 471(c)(3). (tangible and intangible) acquired for resale.

Use Form 1125-A to calculate and deduct A small business taxpayer claiming • The production of real property and

cost of goods sold for certain entities. exemption from the requirement to keep tangible personal property for use in its

inventories is changing its method of trade or business or in an activity engaged

Who Must File accounting for purposes of section 481. in for profit.

Filers of Form 1120, 1120-C, 1120-F, For additional guidance on this method of A small business taxpayer (defined

1120S, or 1065, must complete and attach accounting, see Pub. 538, Accounting above) is not required to capitalize costs

Form 1125-A if the applicable entity reports Periods and Methods. For guidance on under section 263A. See section 263A(i).

a deduction for cost of goods sold. changing to this method of accounting, see

Form 3115 and the Instructions for Form See the discussion on section 263A

Inventories 3115. uniform capitalization rules in the

Generally, inventories are required at the instructions for your tax return before

beginning and end of each tax year if the completing Form 1125-A. Also see

production, purchase, or sale of Regulations sections 1.263A-1 through

1.263A-3. See Regulations section

1.263A-4 for rules for property produced in

a farming business.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 55988R Form 1125-A (Rev. 11-2018)

Form 1125-A (Rev. 11-2018) Page 2

Specific Instructions Per-unit retain allocations. A cooperative Filers that use erroneous valuation

Line 1. Inventory at Beginning of is allowed to deduct from its taxable methods must change to a method

income amounts paid during the payment permitted for federal income tax purposes.

Year period for the tax year as per-unit retain Use Form 3115 to make this change. See

If you are changing your method of allocations to the extent paid in money, the Instructions for Form 3115. Also see

accounting for the current tax year, you qualified per-unit retain certificates, or Pub. 538.

must refigure last year's closing inventory other property with respect to marketing Line 9a. Method of valuing closing

using the new method of accounting. Enter occurring during the tax year. A per-unit inventory. On line 9a, check the method(s)

the result on line 1. If there is a difference retain allocation is any allocation from a used for valuing inventories. Under lower of

between last year's closing inventory and cooperative to a patron for products cost or market, the term “market” (for

the refigured amount, attach an marketed for him without reference to the normal goods) means the current bid price

explanation and take it into account when cooperative net earnings. A qualified per- prevailing on the inventory valuation date

figuring any section 481(a) adjustment. unit retain certificate is any per-unit retain for the particular merchandise in the

Line 2. Purchases certificate that the distributee has agreed volume usually purchased by the filer. For a

to take into account at its stated dollar manufacturer, market applies to the basic

Reduce purchases by items withdrawn for amount. elements of cost—raw materials, labor, and

personal use. For a partnership, the cost of Nonqualified per-unit retain certificates burden. If section 263A applies, the basic

these items should be shown on Schedule redeemed this year. Include the amount elements of cost must reflect the current

K and Schedule K-1 as distributions to paid in money or other property (except bid price of all direct costs and all indirect

partners. amounts already included as per-unit retain costs properly allocable to goods on hand

Line 4. Additional Section 263A certificates) to patrons to redeem at the inventory date.

Costs nonqualified per-unit retain certificates. No Inventory may be valued below cost

deduction is allowed at the time of when the merchandise is unsalable at

If you elected a simplified method of issuance for a nonqualified per-unit retain normal prices or unusable in the normal

accounting, enter on line 4 the balance of certificate. However, the cooperative may way because the goods are subnormal due

section 263A costs paid or incurred during take a deduction in the year the certificate to damage, imperfections, shopwear,

the tax year not includible on lines 2, 3, and is redeemed, subject to the stated dollar change of style, odd or broken lots, or

5. amount of the certificate. See section 1383. other similar causes, including second-

If you elected the simplified production Also see the instructions for Form 1120-C, hand goods taken in exchange. The goods

method, additional section 263A costs are line 30h, for a special rule for figuring the may be valued at the bona fide selling

generally those costs, other than interest, cooperative's tax in the year of redemption price, minus the direct cost of disposition

that were not capitalized under your of a nonqualified per-unit retain certificate. (but not less than scrap value). Bona fide

method of accounting immediately prior to Line 7. Inventory at End of Year selling price means actual offering of

the effective date of section 263A, but are See Regulations sections 1.263A-1 through goods during a period ending not later than

now required to be capitalized under 1.263A-3 for details on figuring the amount 30 days after inventory date.

section 263A. For details, see Regulations of additional section 263A costs to be Lines 9c and 9d. LIFO method. If this is

section 1.263A-2(b). included in ending inventory. the first year the Last-in, First-out (LIFO)

If you elected the simplified resale Line 8. Cost of Goods Sold inventory method was either adopted or

method, additional section 263A costs are extended to inventory goods not previously

generally those costs incurred with respect Enter the amount from line 8 on your tax valued under the LIFO method provided in

to the following categories. return as follows. Filers of Form 1120, section 472, attach Form 970, Application

• Off-site storage or warehousing. 1120-C, 1120S, and 1065, enter cost of To Use LIFO Inventory Method, or a

• Purchasing. goods sold on page 1, line 2. Filers of Form statement with the information required by

1120-F, enter cost of goods sold on Form 970. Check the LIFO box on line 9c.

• Handling, such as processing, Section II, line 2. On line 9d, enter the amount of total

assembling, repackaging, and transporting. Lines 9a Through 9f. Inventory closing inventories computed under

• General and administrative costs (mixed section 472. Estimates are acceptable.

service costs). Valuation Methods If you changed or extended your

Line 5. Other Costs Inventories can be valued at: inventory method to LIFO and had to write

Enter on line 5 any costs paid or incurred • Cost, up the opening inventory to cost in the year

during the tax year not entered on lines 2 • Cost or market value (whichever is lower), of election, report the effect of the write-up

through 4. Attach a statement listing details or as other income, on your applicable return,

of the costs. proportionately over a 3-year period that

• Any other method approved by the IRS begins with the year of the LIFO election.

Special Rules for Cooperatives that conforms to the requirements of the

applicable regulations cited below.

Cooperatives are allowed to deduct certain

per-unit retain allocations. Include these

costs on line 5. Attach a statement listing

details of per-unit retain allocations paid in:

• Qualified per-unit retain certificates,

• Money or other property (except

nonqualified per-unit certificates), and

• Nonqualified per-unit retain certificates

redeemed this year.

Form 1125-A (Rev. 11-2018) Page 3

Note: Entities using the LIFO method that information. We need it to ensure that you The time needed to complete and file

make an S corporation election or transfer are complying with these laws and to allow this form will vary depending on individual

LIFO inventory to an S corporation in a us to figure and collect the right amount of circumstances. The estimated burden for

nonrecognition transaction may be subject tax. business taxpayers filing this form is

to an additional tax attributable to the LIFO You are not required to provide the approved under OMB control number

recapture amount. See the instructions for information requested on a form that is 1545-0123 and is included in the estimates

Form 1120, Schedule J, line 11. subject to the Paperwork Reduction Act shown in the instructions for their business

Line 9e. If property is produced or unless the form displays a valid OMB income tax return.

acquired for resale and the rules of section control number. Books or records relating If you have comments concerning the

263A apply to the corporation, cooperative, to a form or its instructions must be accuracy of these time estimates or

partnership, or other applicable entity, retained as long as their contents may suggestions for making this form simpler,

check the “Yes” box on line 9e. become material in the administration of we would be happy to hear from you. See

any Internal Revenue law. Generally, tax the instructions for the tax return with

Paperwork Reduction Act Notice. We returns and return information are which this form is filed.

ask for the information on this form to carry confidential, as required by section 6103.

out the Internal Revenue laws of the United

States. You are required to give us the

no reviews yet

Please Login to review.