229x Filetype PDF File size 0.53 MB Source: vittoriasilvestri.files.wordpress.com

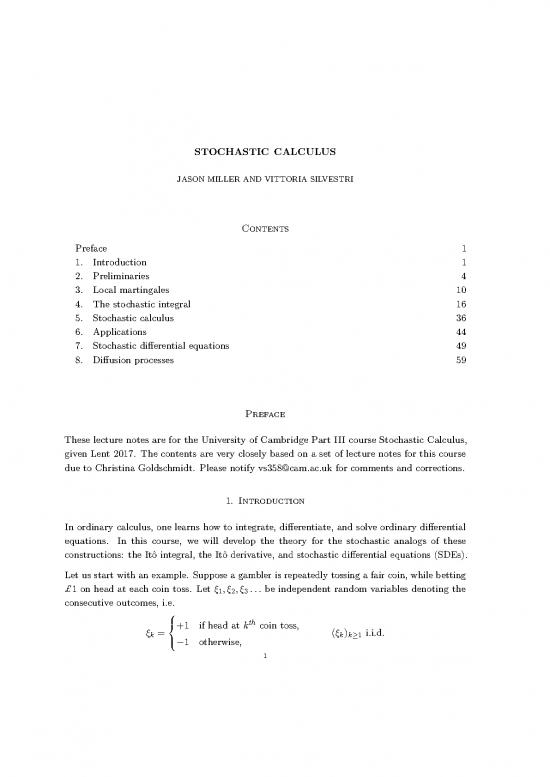

STOCHASTIC CALCULUS

JASONMILLERANDVITTORIASILVESTRI

Contents

Preface 1

1. Introduction 1

2. Preliminaries 4

3. Local martingales 10

4. The stochastic integral 16

5. Stochastic calculus 36

6. Applications 44

7. Stochastic differential equations 49

8. Diffusion processes 59

Preface

These lecture notes are for the University of Cambridge Part III course Stochastic Calculus,

given Lent 2017. The contents are very closely based on a set of lecture notes for this course

due to Christina Goldschmidt. Please notify vs358@cam.ac.uk for comments and corrections.

1. Introduction

In ordinary calculus, one learns how to integrate, differentiate, and solve ordinary differential

equations. In this course, we will develop the theory for the stochastic analogs of these

constructions: the Itˆo integral, the Itˆo derivative, and stochastic differential equations (SDEs).

Let us start with an example. Suppose a gambler is repeatedly tossing a fair coin, while betting

£1 on head at each coin toss. Let ξ ,ξ ,ξ ... be independent random variables denoting the

1 2 3

consecutive outcomes, i.e.

ξ =+1 if head at kth coin toss, (ξ ) i.i.d.

k −1 otherwise, k k≥1

1

2 JASONMILLERANDVITTORIASILVESTRI

Then the gambler’s net winnings after n coin tosses are given by X := ξ + ξ + ... + ξ .

n 1 2 n

Note that (X ) is a simple random walk on Z starting at X = 0, and it is therefore a

n n≥0 0

discrete time martingale with respect to the filtration (F ) generated by the outcomes, i.e.

th n n≥0

F =σ(ξ ,...,ξ ). Now suppose that, at the m coin toss, the gambler bets an amount H

n 1 n m

on head (we can also allow Hm to be negative by interpreting it as a bet on tail). Take, for

now, (H ) to be deterministic (for example, the gambler could have decided in advance

m m≥1

the sequence of bets). Then it is easy to see that

n

(1.1) (H·X) :=XH (X −X )

n k k k−1

k=1

gives the net winnings after n coin tosses. We claim that the stochastic process H · X

is a martingale with respect to (F ) . Indeed, integrability and adaptedness are clear.

n n≥0

Furthermore,

�

(1.2) E (H ·X) −(H·X)

F =H E(X −X |F )=0

n+1 n n n+1 n+1 n n

for all n ≥ 1, which shows that H · X is a martingale. In fact, this property is much more

general. Indeed, instead of deciding his bets in advance, the gambler might want to allow its

(n+1)th bet to depend on the first n outcomes. That is, we can take Hn+1 to be random, as long

as it is Fn-measurable. Such processes are called previsible, and they will play a fundamental

role in this course. In this more general setting, (H · X)n still represents the net amount of

winnings after n bets, and (1.2) still holds, so that H · X is again a discrete time martingale.

For this reason, the process H · X is usually referred to as discrete martingale transform.

Remark 1.1. This teaches us that we cannot make money by gambling on a fair game!

Our goal for the first part of the course is to generalise the above reasoning to the continuous

time setting, i.e. to define the process

Z tH dX

s s

0

1

for (H ) suitable previsible process and (X ) continuous martingale (think, for example,

t t≥0 t t≥0

of X as being standard one-dimensional Brownian Motion, the analogue to a simple random

walk in the continuum). To achieve this, as a first attempt one could try to generalise the

Lebesgue-Stieltjes theory of integration to more general integrators: this will lead us to talk

about finite variation processes. Unfortunately, as we will see, the only continuous martingales

which have finite variation are the constant ones, so a new theory is needed in order to integrate,

for example, with respect to Brownian Motion. This is what is commonly called Itˆo’s theory

of integration. To see how one could go to build this new theory, note that definition (1.1) is

1

At this point we have not yet defined the notion of previsible process in the continuous time setting: this

will be clarified later in the course.

STOCHASTIC CALCULUS 3

perfectly well-posed in continuous time whenever the integrand H is piecewise constant taking

only finitely many values. In order to accommodate more general integrands, one could then

think to take limits, setting, for example,

⌊t/ε⌋

(1.3) (H·X) ”:=” lim XH (X −X ).

t ε→0 kε (k+1)ε kε

k=0

Onthe other hand, one quickly realises that the r.h.s. above in general does not converge in the

usual sense, due to the roughness of X (think, for example, to Brownian Motion). What is the

right notion of convergence that makes the above limit finite? As we will see in the construction

of Itˆo integral, to get convergence one has to exploit the cancellations in the above sum. As an

example, take X to be Brownian Motion, and observe that

⌊t/ǫ⌋

X 2

E H (X −X ) =

kε (k+1)ε kε

k=0

⌊t/ε⌋ ⌊t/ε⌋

=E XH2 �X −X 2+XH H (X −X )(X −X )

kε (k+1)ε kε jε kε (k+1)ε kε (j+1)ε jε

k=0 j6=k

⌊t/ε⌋ ⌊t/ε⌋ Z t

=E XH2 �X −X 2 =ε XH2 → H2ds as ε→0,

kε (k+1)ε kε kε s

k=0 k=0 0

where the cancellations are due to orthogonality of the martingale increments. These type

of considerations will allow us to provide a rigorous construction of the Itˆo integral for X

continuous martingale (such as Brownian Motion), and in fact even for slightly more general

integrands, namely local martingales and semimartingales.

Oncethestochastic integral has been defined, we will discuss its properties and applications. We

will look, for example, at iterated integrals, the stochastic chain rule and stochastic integration

by part. Writing, to shorten the notation,

dY =HdX

t t t

to mean Y = RtH dX , we will learn how to express df(Y ) in terms of dY by mean of the

t 0 s s t t

celebrated Itˆo’s formula. This is an extremely useful tool, of which we will present several

applications. For example, we will be able to show that any continuous martingale is a

time-changed Brownian Motion (this is the so-called Dubins-Schwarz theorem).

In the second part of the course we will then focus on the study of Stochastic Differential

Equations (SDEs in short), that is equations of the form

(1.4) dX =b(t,X )dt+σ(t,X )dB , X =x ,

t t t t 0 0

4 JASONMILLERANDVITTORIASILVESTRI

for suitably nice functions a,σ. These can be thought of as arising from randomly perturbed

ODEs. To clarify this point, suppose we are given the ODE

dx(t)

(1.5) dt =b(t,x(t)),

x(0) = x ,

0

which writes equivalently as x(t) = x +Rtb(s,x(s))ds. In many applications we may wish to

0 0

perturb (1.5) by adding some noise, say Brownian noise. This gives a new (stochastic) equation

X =x +Z tb(s,X )ds+σB ,

t 0 s t

0

where the real parameter σ controls the intensity of the noise. In fact, we may also want to

allow such intensity to depend on the current time and state of the system, to get

X =x +Z tb(s,X )ds+Z tσ(s,X )dB ,

t 0 s s s

0 0

where the last term is an Itˆo integral. This, written in differential form, gives (1.4). Of such

SDEs we will present several notions of solutions, and discuss under which conditions on the

functions b and σ such solutions exist and are unique.

Finally, in the last part of the course we will talk about diffusion processes, which are Markov

processes characterised by martingales properties. We will explain how such processes can be

constructed from SDEs, and how they can be used to build solutions to certain (deterministic)

PDEs involving second order elliptic operators.

2. Preliminaries

2.1. Finite variation integrals. Recall that a function a: [0,∞) → R is said to be c´adl´ag if

it is right-continuous and has left limits. In other words, for all x ∈ (0,∞) we have both

lim a(y) exists and lim a(y) = a(x).

− +

y→x y→x

− −

We write a(x ) for the left limit at x, and let ∆a(x) := a(x) − a(x ). Assume that a is

non-decreasing and c´adl´ag with a(0) = 0. Then there exists a unique Borel measure da on

[0,∞) such that for all s < t, we have that

da((s,t]) = a(t) − a(s).

For any f : R → R measurable and integrable function we can define the Lebesgue-Stieltjes

integral f · a by setting Z

(f · a)(t) = (0,t] f(s)da(s)

no reviews yet

Please Login to review.