183x Filetype PDF File size 0.54 MB Source: knavcpa.com

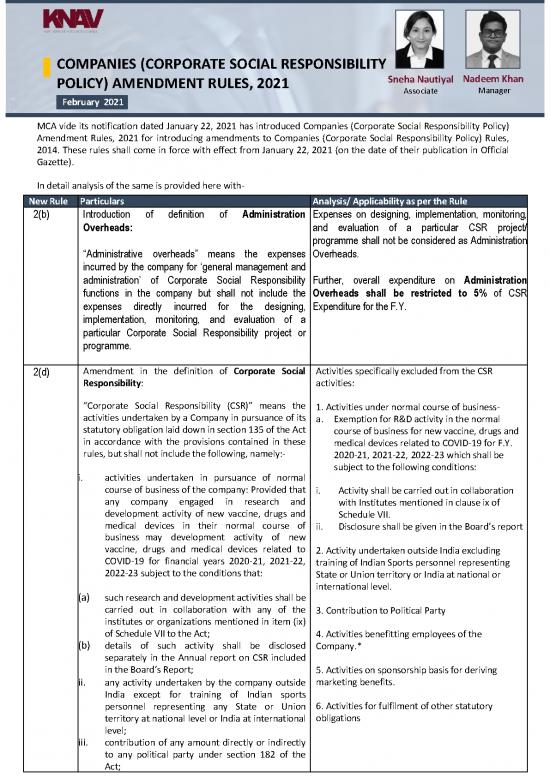

COMPANIES (CORPORATE SOCIAL RESPONSIBILITY

POLICY) AMENDMENT RULES, 2021 Sneha Nautiyal Nadeem Khan

Associate Manager

February 2021

MCAvideits notification dated January 22, 2021 has introduced Companies (Corporate Social Responsibility Policy)

Amendment Rules, 2021 for introducing amendments to Companies (Corporate Social Responsibility Policy) Rules,

2014. These rules shall come in force with effect from January 22, 2021 (on the date of their publication in Official

Gazette).

In detail analysis of the same is provided here with-

NewRule Particulars Analysis/ Applicability as per the Rule

2(b) Introduction of definition of Administration Expenses on designing, implementation, monitoring,

Overheads: and evaluation of a particular CSR project/

programme shall not be considered as Administration

“Administrative overheads” means the expenses Overheads.

incurred by the company for ‘general management and

administration’ of Corporate Social Responsibility Further, overall expenditure on Administration

functions in the company but shall not include the Overheads shall be restricted to 5% of CSR

expenses directly incurred for the designing, Expenditurefor theF.Y.

implementation, monitoring, and evaluation of a

particular Corporate Social Responsibility project or

programme.

2(d) Amendment in the definition of Corporate Social Activities specifically excluded from the CSR

Responsibility: activities:

“Corporate Social Responsibility (CSR)” means the 1. Activities under normal course of business-

activities undertaken by a Company in pursuance of its a. Exemption for R&D activity in the normal

statutory obligation laid down in section 135 of the Act course of business for new vaccine, drugs and

in accordance with the provisions contained in these medical devices related to COVID-19 for F.Y.

rules, but shall not include the following, namely:- 2020-21, 2021-22, 2022-23 which shall be

subject to the following conditions:

i. activities undertaken in pursuance of normal

course of business of the company: Provided that i. Activity shall be carried out in collaboration

any company engaged in research and with Institutes mentioned in clause ix of

development activity of new vaccine, drugs and Schedule VII.

medical devices in their normal course of ii. Disclosure shall be given in the Board’s report

business may development activity of new

vaccine, drugs and medical devices related to 2. Activity undertaken outside India excluding

COVID-19 for financial years 2020-21, 2021-22, training of Indian Sports personnel representing

2022-23 subject to the conditions that: State or Union territory or India at national or

international level.

(a) such research and development activities shall be

carried out in collaboration with any of the 3. Contribution to Political Party

institutes or organizations mentioned in item (ix)

of Schedule VII to the Act; 4. Activities benefitting employees of the

(b) details of such activity shall be disclosed Company.*

separately in the Annual report on CSR included

in the Board’s Report; 5. Activities on sponsorship basis for deriving

ii. any activity undertaken by the company outside marketing benefits.

India except for training of Indian sports

personnel representing any State or Union 6. Activities for fulfilment of other statutory

territory at national level or India at international obligations

level;

iii. contribution of any amount directly or indirectly

to any political party under section 182 of the

Act;

activities benefitting employees of the company as

defined in clause (k) of section 2 of the Code on

Wages,2019(29of2019);

activities supported by the companies on

sponsorship basis for deriving marketing benefits for

its products or services;

activities carried out for fulfilment of any other

statutory obligations under any law in force in India;

2(i) Introduction of definition of “Ongoing Project” Company can categorize their CSR projects as

“Ongoing Project” which shall be maximum of 3 years

“Ongoing Project” means a multi-year project(excluding theFYinwhichitwascommenced)

undertaken by a Company in fulfilment of its CSR

obligation having timelines not exceeding threeFurther, this shall include those projects which were

years excluding the financial year in which it wasextended beyond 1 year (subject to maximum of 3

commenced and shall include such project that wasyears)

initially not approved as a multi-year project but

whoseduration has been extended beyond one year

bytheboardbasedonreasonablejustification.

4 Substitution of new Rule 4 – CSR Implementation 1. CSR Activities shall be undertaken by the

1. The Board shall ensure that the CSR activities Company itself or through the Section 8

are undertaken by the company itself or Companies registered under 12A and 80G

through (incorporated/ established by the Company or

any existing Company or Central/State

a) companyestablished under section 8 of the Act, Government)

or a registered public trust or a registered2. Such Section 8 Company should have a track

society, registered under section 12A and 80 G record of at least 3 years.

of the Income Tax Act, 1961 (43 of 1961),3. Company who undertakes CSR Activity shall

established by the company, either singly or register with CG in Form CSR – 1 w.e.f. April 01,

alongwithanyothercompany,or 2021.

b) company established under section 8 of the Act4. The Companies filing Form CSR-1 shall be allotted

or a registered trust or a registered society, a unique CSR Registration Number which shall be

established by the Central Government or State automatically generated on submission of the

Government; or Form.

c) any entity established under an Act of5. Theprovisionsofthissub-ruleshallnotaffect the

ParliamentoraState legislature; or ongoing CSR projects/ programmes approved

d) companyestablished under section 8 of the Act, prior to April 01, 2021.

or a registered public trust or a registered6. The Companies shall be allowed to collaborate

society, registered under section 12A and 80G with other Companies for undertaking CSR

of the Income Tax Act, 1961, and having an projects/ programmes/ activities only in a

established track record of at least three years manner that the CSR committees of the

in undertaking similar activities. respective companies are in a position to report

these activity separately in their Board Report.

(2) (a) Every entity, covered under sub-rule (1), who7. Certification (Certify) from the CFO for the funds

intends to undertake any CSR activity, shall register so disbursed have been utilized for the purposes

itself with the Central Government by filing the form and in the manner as approved by the

CSR-1 electronically with the Registrar, with effect Board/Committee.

fromthe01stdayofApril2021: 8. The Board shall monitor the progress of the

project with reference to the approved timelines

Provided that the provisions of this sub-rule shall not andyear-wise allocation.

affect the CSR projects or programmes approved

prior to the 1st day of April 2021.

of April 2021.

Form CSR-1 shall be signed and submitted electronically by

the entity and shall be verified digitally by a Chartered

Accountant in practice or a Company Secretary in practice or a

Cost Accountant in practice.

On the submission of the Form CSR-1 on the portal, a unique

CSR Registration Number shall be generated by the system

automatically.

(3) A company may engage international organizations for

designing, monitoring and evaluation of the CSR projects or

programmes as per its CSR policy as well as for capacity

building of their own personnel for CSR.

(4) A company may also collaborate with other companies for

undertaking projects or programmes or CSR activities in such

a manner that the CSR committees of respective companies

are in a position to report separately on such projects or

programmes in accordance with these rules.

(5) The Board of a company shall satisfy itself that the funds

so disbursed have been utilized for the purposes and in the

manner as approved by it and the Chief Financial Officer or

the person responsible for financial management shall certify

to the effect.

(6) In case of ongoing project, the Board of a Company shall

monitor the implementation of the project with reference to

the approved timelines and year-wise allocation and shall be

competent to make modifications, if any, for smooth

implementation of the project within the overall permissible

time period.

5(2) Substitution of new Rule 5(2): The additional function of the CSR

Committee shall include formulating and

The CSR Committee shall formulate and recommend to the recommending to the Board, an annual

Board, an annual action plan in pursuance of its CSR policy, action plan in pursuance of its CSR policy.

which shall include the following, namely:-

a) the list of CSR projects or programmes that are approved

to be undertaken in areas or subjects specified in

Schedule VII of the Act;

b) the manner of execution of such projects or programmes

as specified in sub-rule (1) of rule 4;

c) the modalities of utilization of funds and implementation

schedules for the projects or programmes;

d) monitoring and reporting mechanism for the projects or

programmes; and

e) details of need and impact assessment, if any, for the

projects undertaken by the company: Provided that

Board may alter such plan at any time during the financial

year, as per the recommendation of its CSR Committee,

based on the reasonable justification to that effect

Substitution of new Rule 7 – CSR Expenditure: Overall expenditure on Administration

Overheads shall be restricted to 5% of CSR

1) The board shall ensure that the administrative Expenditure for the F.Y.

overheads shall not exceed five percent of total

CSR expenditure of the company for the financial Surplus funds shall be transferred to the same

year. project or shall be transferred to the Unspent

2) Any surplus arising out of the CSR activities shall CSR Account and spent in pursuance of CSR

not form part of the business profit of a company policy and annual action plan of the company or

transfer such surplus amount to a Fund specified

and shall be ploughed back into the same project or

shall be transferred to the Unspent CSR Account in Schedule VII, within a period of 6 months of

and spent in pursuance of CSR policy and annual the expiry of the F.Y.

action plan of the company or transfer such surplus

Excess amount spent can be set off against the

amount to a Fund specified in Schedule VII, within a

period of six months of the expiry of the financial requirement of Section 135(5) up to immediate

year. succeeding 3rd F.Y. subject to the

3) Where a company spends an amount in excess of conditions that –

requirement provided under sub-section (5) of (a) the excess amount available for set off shall

section 135, such excess amount may be set off not include the surplus arising out of the CSR

against the requirement to spend under sub- activities, if any, in pursuance of sub-rule (2) of

section (5) of section 135 up to immediate this rule.

succeeding three financial years subject to the (b) the Board of the company shall pass a

conditions that – resolution to that effect.

the excess amount available for set off shall

not include the surplus arising out of the CSR The CSR amount may be spent by a company for

activities, if any, in pursuance of sub-rule (2) of creation or acquisition of a capital asset, which

this rule.(ii) the Board of the company shall shall be held by:

pass a resolution to that effect. a. company established under section 8 of the

Act, or a Registered Public Trust or Registered

4) The CSR amount may be spent by a company for Society, having charitable objects and CSR

Registration Number under sub-rule

creation or acquisition of a capital asset, which shall

be held by -

(2) of rule 4; or

a) a company established under section 8 of b. beneficiaries of the said CSR project, in the

the Act, or a Registered Public Trust or form of self-help groups, collectives, entities; or

Registered Society, having charitable

objects and CSR Registration Number c. a public authority:

under sub-rule (2) of rule 4; or

b) beneficiaries of the said CSR project, in Provided that any capital asset created by a

the form of self-help groups, collectives, company prior to the commencement of the

entities; Companies (CSR Policy) Amendment Rules,

c) or a public authority: 2021, shall within a period of 180 days from

such commencement comply with the

requirement of this rule, which may be

extended by a further period of not more than

90 days with the approval of the Board based on

reasonable justification.

no reviews yet

Please Login to review.