274x Filetype XLSX File size 0.03 MB Source: www.revenue.nh.gov

Sheet 1: Summary

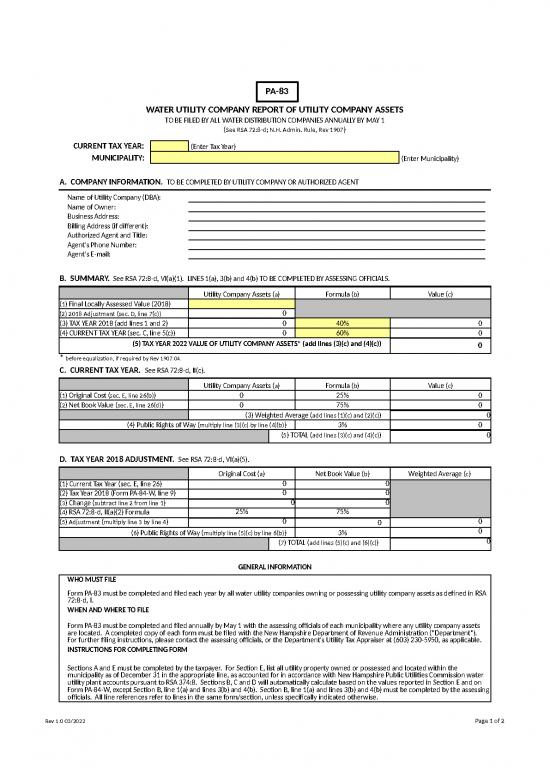

| WATER UTILITY COMPANY REPORT OF UTILITY COMPANY ASSETS | ||||||||||||||

| TO BE FILED BY ALL WATER DISTRIBUTION COMPANIES ANNUALLY BY MAY 1 | ||||||||||||||

| (See RSA 72:8-d; N.H. Admin. Rule, Rev 1907) | ||||||||||||||

| CURRENT TAX YEAR: | (Enter Tax Year) | |||||||||||||

| MUNICIPALITY: | (Enter Municipality) | |||||||||||||

| A. COMPANY INFORMATION. TO BE COMPLETED BY UTILITY COMPANY OR AUTHORIZED AGENT | ||||||||||||||

| Name of Utility Company (DBA): | ||||||||||||||

| Name of Owner: | ||||||||||||||

| Business Address: | ||||||||||||||

| Billing Address (if different): | ||||||||||||||

| Authorized Agent and Title: | ||||||||||||||

| Agent's Phone Number: | ||||||||||||||

| Agent's E-mail: | ||||||||||||||

| 5-Year Phase-In Period Weighting | ||||||||||||||

| B. SUMMARY. See RSA 72:8-d, VI(a)(1). LINES 1(a), 3(b) and 4(b) TO BE COMPLETED BY ASSESSING OFFICIALS. | Tax Year | % 2018 Final Locally Assessed Value | % Current Year Value | |||||||||||

| Utility Company Assets (a) | Formula (b) | Value (c) | ||||||||||||

| (1) Final Locally Assessed Value (2018) | 2020 | 80% | 20% | |||||||||||

| (2) 2018 Adjustment (sec. D, line 7(c)) | 0 | 2021 | 60% | 40% | ||||||||||

| (3) TAX YEAR 2018 (add lines 1 and 2) | 0 | 40% | 0 | 2022 | 40% | 60% | ||||||||

| (4) CURRENT TAX YEAR (sec. C, line 5(c)) | 0 | 60% | 0 | 2023 | 20% | 80% | ||||||||

| (5) TAX YEAR 2022 VALUE OF UTILITY COMPANY ASSETS* (add lines (3)(c) and (4)(c)) | 0 | 2024 | 0% | 100% | ||||||||||

| * before equalization, if required by Rev 1907.04. | ||||||||||||||

| C. CURRENT TAX YEAR. See RSA 72:8-d, II(c). | ||||||||||||||

| Utility Company Assets (a) | Formula (b) | Value (c) | ||||||||||||

| (1) Original Cost (sec. E, line 26(b)) | 0 | 25% | 0 | |||||||||||

| (2) Net Book Value (sec. E, line 26(d)) | 0 | 75% | 0 | |||||||||||

| (3) Weighted Average (add lines (1)(c) and (2)(c)) | 0 | |||||||||||||

| (4) Public Rights of Way (multiply line (3)(c) by line (4)(b)) | 3% | 0 | ||||||||||||

| (5) TOTAL (add lines (3)(c) and (4)(c)) | 0 | |||||||||||||

| D. TAX YEAR 2018 ADJUSTMENT. See RSA 72:8-d, VI(a)(5). | ||||||||||||||

| Original Cost (a) | Net Book Value (b) | Weighted Average (c) | ||||||||||||

| (1) Current Tax Year (sec. E, line 26) | 0 | 0 | ||||||||||||

| (2) Tax Year 2018 (Form PA-84-W, line 9) | 0 | 0 | ||||||||||||

| (3) Change (subtract line 2 from line 1) | 0 | 0 | ||||||||||||

| (4) RSA 72:8-d, II(a)(2) Formula | 25% | 75% | ||||||||||||

| (5) Adjustment (multiply line 3 by line 4) | 0 | 0 | 0 | |||||||||||

| (6) Public Rights of Way (multiply line (5)(c) by line 6(b)) | 3% | 0 | ||||||||||||

| (7) TOTAL (add lines (5)(c) and (6)(c)) | 0 | |||||||||||||

| GENERAL INFORMATION | ||||||||||||||

| WHO MUST FILE | ||||||||||||||

| Form PA-83 must be completed and filed each year by all water utility companies owning or possessing utility company assets as defined in RSA 72:8-d, I. | ||||||||||||||

| WHEN AND WHERE TO FILE | ||||||||||||||

| Form PA-83 must be completed and filed annually by May 1 with the assessing officials of each municipality where any utility company assets are located. A completed copy of each form must be filed with the New Hampshire Department of Revenue Administration ("Department"). For further filing instructions, please contact the assessing officials, or the Department's Utility Tax Appraiser at (603) 230-5950, as applicable. | ||||||||||||||

| INSTRUCTIONS FOR COMPLETING FORM | ||||||||||||||

| Sections A and E must be completed by the taxpayer. For Section E, list all utility property owned or possessed and located within the municipality as of December 31 in the appropriate line, as accounted for in accordance with New Hampshire Public Utilities Commission water utility plant accounts pursuant to RSA 374:8. Sections B, C and D will automatically calculate based on the values reported in Section E and on Form PA-84-W, except Section B, line 1(a) and lines 3(b) and 4(b). Section B, line 1(a) and lines 3(b) and 4(b) must be completed by the assessing officials. All line references refer to lines in the same form/section, unless specifically indicated otherwise. | ||||||||||||||

| WATER UTILITY COMPANY REPORT OF UTILITY COMPANY ASSETS | ||||

| E. CURRENT TAX YEAR as of December 31 of previous year | Municipality: | 0 | ||

| Line No. | Account (a) |

Original Cost (b) |

Accumulated Depreciation (c) |

Net Book Value (d) |

| DISTRIBUTION PLANT | ||||

| 1 | (303) Fee-Owned Land | - | ||

| 2 | (303) Land Rights | - | ||

| 3 | (304) Structures and Improvements | - | ||

| 4 | (305) Collecting and Impounding Reservoirs | - | ||

| 5 | (306) Lake, River and Other Intakes | - | ||

| 6 | (307) Wells and Springs | - | ||

| 7 | (308) Infiltration Galleries and Tunnels | - | ||

| 8 | (309) Supply Mains | - | ||

| 9 | (310) Power Generation Equipment | - | ||

| 10 | (311) Pumping Equipment | - | ||

| 11 | (320) Water Treatment Equipment | - | ||

| 12 | (330) Distribution Reservoirs and Standpipes | - | ||

| 13 | (331) Transmission and Distribution Mains | - | ||

| 14 | (333) Services | - | ||

| 15 | (334) Meters and Meter Installations | - | ||

| 16 | (335) Hydrants | - | ||

| 17 | (339) Other Plant and Miscellaneous Equipment | - | ||

| 18 | TOTAL DISTRIBUTION PLANT (add lines 1-17) | - | - | - |

| 19 | (Less) (303) Land and Land Rights (add lines 1 and 2) | - | - | - |

| 20 | (Less) Office Buildings, Garages, and Warehouses | - | ||

| 21 | (Less) Electric power fixtures employed solely as an emergency source of electric power in a public water distribution system | - | ||

| 22 | NET DISTRIBUTION PLANT (subtract lines 19-21 from line 18) | - | - | - |

| 23 | CIAC (distribution) (if not included in line 22) | - | ||

| 24 | CWIP (distribution) (if not included in line 22) | - | ||

| 25 | Undistributed Plant (distribution) (if not included in line 22) | - | ||

| 26 | UTILITY COMPANY ASSETS (RSA 72:8-d, I) (add lines 22-25) | - | - | - |

| OTHER ASSETS | ||||

| 27 | (301) Intangible Plant | - | ||

| 28 | (340) Office Furniture and Equipment | - | ||

| 29 | (341) Transportation Equipment | - | ||

| 30 | (342) Stores Equipment | - | ||

| 31 | (343) Tools, Shop and Garage Equipment | - | ||

| 32 | (344) Laboratory Equipment | - | ||

| 33 | (345) Power Operated Equipment | - | ||

| 34 | (346) Communication Equipment | - | ||

| 35 | (347) Computer Equipment | - | ||

| 36 | (348) Other Miscellaneous Equipment | - | ||

| 37 | CIAC - Other Assets (if not included in line 23) | - | ||

| 38 | CWIP - Other Assets (if not included in line 24) | - | ||

| 39 | Undistributed Plant - Other Assets (if not included in line 25) | - | ||

| 40 | TOTAL OTHER ASSETS (add lines 27-39) | - | - | - |

| 41 | Land and Land Rights (from line 19) | - | ||

| 42 | Office Buildings, Garages, and Warehouses (from line 20) | - | ||

| 43 | Electric power fixtures employed solely as an emergency source of electric power (from line 21) | - | ||

| 44 | TOTAL UTILITY PROPERTY (add lines 26, 40-43) | - | - | - |

no reviews yet

Please Login to review.