207x Filetype PDF File size 2.38 MB Source: www.timriley.com.au

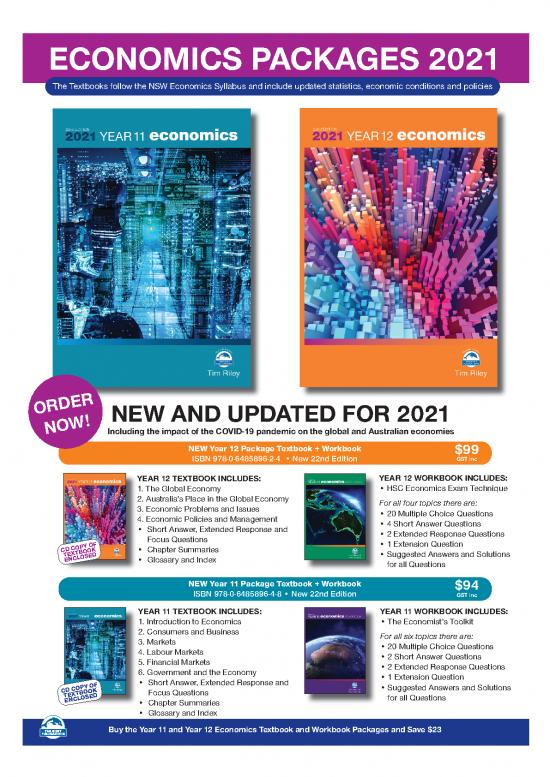

ECONOMICS PACKAGES 2021

The Textbooks follow the NSW Economics Syllabus and include updated statistics, economic conditions and policies

ORDER NEW AND UPDATED FOR 2021

NOW! Including the impact of the COVID-19 pandemic on the global and Australian economies

NEW Year 12 Package Textbook + Workbook $99

ISBN 978-0-6485896-2-4 New 22nd Edition GST inc

YEAR 12 TEXTBOOK INCLUDES: YEAR 12 WORKBOOK INCLUDES:

1. The Global Economy HSC Economics Exam Technique

2. Australia’s Place in the Global Economy For all four topics there are:

3. Economic Problems and Issues 20 Multiple Choice Questions

4. Economic Policies and Management 4 Short Answer Questions

Short Answer, Extended Response and 2 Extended Response Questions

Focus Questions 1 Extension Question

CD COPY OF Chapter Summaries

OOK Suggested Answers and Solutions

TEXTB

OSED

ENCL Glossary and Index for all Questions

NEW Year 11 Package Textbook + Workbook $94

ISBN 978-0-6485896-4-8 New 22nd Edition GST inc

YEAR 11 TEXTBOOK INCLUDES: YEAR 11 WORKBOOK INCLUDES:

1. Introduction to Economics The Economist’s Toolkit

2. Consumers and Business For all six topics there are:

3. Markets 20 Multiple Choice Questions

4. Labour Markets 2 Short Answer Questions

5. Financial Markets 2 Extended Response Questions

6. Government and the Economy 1 Extension Question

Short Answer, Extended Response and Suggested Answers and Solutions

CD COPY OF

OOK Focus Questions

TEXTB

OSED for all Questions

ENCL Chapter Summaries

Glossary and Index

Buy the Year 11 and Year 12 Economics Textbook and Workbook Packages and Save $23

2021 Package flyer.indd 12021 Package flyer.indd 1 6/7/20 12:15 pm6/7/20 12:15 pm

Clear Gr R

e

vie

ysis aphs and T w Ques

©

T

Skills Outcomes ables im Riley Publications Pty Ltd Chapter 4: tions

©

T

Economic Anal im Riley Publications Pty Ltd Chapter 4:

105

rade and Financial Flows

T

s

Australia’ W

ith Australia’

world Australia’

gr

o s

wth T

and av rade and Financial Flows s

T

this led eraging rade and Financial Flows

to 5% REVIEW

mineral rising in

’S global 2010

and and 119 RECENT TRENDS IN AUSTRALIA

metal commodity 4%

The Textbooks follow in

wheat expor 2011,

ts. prices. the

im Riley Publications Pty Ltd Chapter 4: and P global 123

T wool, rice A

© expor coking rises ustralia demand

in benefited 1. QUESTIONS

t price coal the for

y commodities

index (47%) ear What is meant by inter

to fr

was M om

r and ay

2 sour ose b ir 2011 the rising incr

t Markets in 2018-19 ced y 27.3% on w eased

or er

fr e e prices 2.

th East Asia 63.3% betw om in (33%) large

Nor China 2010-11. as for for How does inter

een 7% and 10% in 2010-11, compar sho rural its

and wn commodities rural, national competitiveness? How is it measured?

other M in ’S BALANCE OF P

uch T changes in competitiveness in the 2000s in Figure 4.8 in your answer

Asian of this able 4.13

AUSTRALIA countries str . such national competitiveness impact on Australia’

ong As as

Figure 4.3: Major Australian Expor a

ASEAN 10.9% which r

global esult, 3.

sustained A

T demand ustralia Define the ‘ter

ed with 2% to 4% in the major adv

able 4.13: Changes in Commodity Prices ’

the NSW Economics higher for s

rates commodities A

EU 5.7% of 4. ms of trade’ and explain how the ter YMENTS

Bulk Commodities economic Distinguish between the implications of favourable and unfavourable movements in Australia’

PLACE IN gr

o

anced countries. wth

31% Y of terms of trade on the current account deficit by referring to T s trade per

India 4.3% - ear to May 2019 and (Y

Iron ore (35.3%) 5. Define formance? Refer to the

55% ear to May 2011) ms of trade index is measured and interpreted.

n to USA 3.8% - Coking coal (33%) Base net .

THE GLOBAL metals 6. foreign

opic 2 of the - Ther 19% (47%) Gold -14% (-12.6%) How is Australia’ liabilities

liabilities and net foreign debt? Refer to T

Syllabus and include Other 12% mal coal and

distinguish

mance. Students should lear able 14a s current account deficit linked to Australia’

s place in the global economy and the effect of for or Rural -12% (26%) Brent crude oil 0% 7. between able 4.12.

egion (20%)

ECONOMY r How may the accumulation of a large net foreign debt impose economic costs on Australia?

major

s economic per Catalogue 5368.0, June. T to for net

vices, ding 2% (48.6%) foreign

accor accounted -7% (30%) 8.

2018-19 which to Source: Reser Discuss the benefits and costs of foreign investment in Australia. debt s

in ong, 5.7%

rade in Goods and Ser exports K ve Bank of Australia (2011 and 2019), able 4.14 in your answer and

s ong

TOPIC FOCUS national T ’ H countries; 9. net

Inter and East, Reser

s growing stock of net foreign

ustralia foreign

A aiwan ASEAN iddle ve Bank Index Which countries are the main sources of foreign investment in Australia?

for T ten M

ea, the equity

This topic focuses on an examination of Australia’ or the in

Source: ABS (2019), K to ope, The

destinations ent ur Statements on Monetar

apan, E tr .

s trade and financial flows; major J ts w Asia, to 35.6% end 11% (27%) 10. .

changes in the global economy on Australia’ the China, in of

expor the

ws of kets 2007-08 gr rising What is meant by structural change? What are its causes and effects on Australian industr

sho in o

updated statistics, includes 10.9% mar wth terms y Policy

economic e 4.3 Asia other of

14.9%

examine the following economic issues and apply the following economic skills in T ther

s igur to 3% of ,

F East fur om ces. and trade May

orth A 12% ose fr C lo . 11.

N r esour risis, w changed

and e

. er

HSC course: Australia’ y a How is structural change occurring as the Australian economy transitions to non mining growth?

on in 2018-19. USA; t shar e the slo global dramatically

countr er w

economy; ts the w

to s expor economic commodity

flows expor ’ declined b

of 3.8% China (15.8%) r betw 12.

eco prices

Australian ndia, y nearly 40% betwv een

and 63.3% I acific. ASEAN Thailand, er

financial to P e, y in due 2011 How have gover

the

the and the to

and on 4.3% ustralian mineral and agricultural r and

and ingapor for USA the

EU, S 2016

impact

Australia; (17.4%) . Lo and

trade dollar the Africa w een their peak in late 2011 and mid 2016 as sho with of Australian industr

in ASEAN er

in nion able 4.3 in global a slo of

life U T the w

America, in ts w eaker nment policies and changes in the global business cycle caused the structure

of trends er E

ECONOMIC ISSUES opean wn impor economic gr ur world

outh ur highest o opean expor

Australian S E sho of B wth

changes ank

the as ces the ’ rate S

of the quality current s activity

I o

sour had ndex v ts

of of in er

Assess the impact of recent changes in the global economy on Australia’

the 2018-19 China. eign between

(24.4%), in and rance of in y to change in ter

• effects on F commodities 2016 D

value result 2018-19 because of its large demand for A ts kets ustralian 27% ebt 13.

and A The

the a mar

the China impor t of in led terms the

as ts, ces the to Explain how the Australian economy began the transition to non mining sources of growth after

in policies olland the

economic conditions, expor , H sour that y 15% wn in of 1980s

Examine impor ustralian tant as ws ear demand trade

of A sho a general to lo

of ermany M w F

mance; Australia impor tance ay er igur ms of the industr

changes ces G for the end of the mining investment boom in 2012. What impact may this transition to non mining

• for protection n terms , 2011 in commodities e 4.9 and

of I sour most taly incr the

I impor able 4.4 2000s?

per within the in T ease during y .

and tant e ear y?

y er ritain, ext A in to

effects w B N ustralia

impor (3.8%). world the M w sources of growth have on the balance of payments?

trade EU, ay eakening

the ea post

industr most ts in 2018-19. ’ 2016 Refer

ndonesia the or s terms commodity y shares of total GDP

free of I 2018-19. K GFC

and in and compar with

of ithin of to

Analyse W ts the 11% trade. boom. the T

structure alaysia impor (6.9%) ustralian impor and prices ed to R 14. able

• M I F eser

impact ir n r

and on the om a v

2018-19. apan including rise e Define the following ter 4.15

the J (36.9%),

the in ts ces of A or y M

to trade was r e ear ay in

expor (10.2%), Asia prices to coal, 2016 the in

ustralia East China b M index your , employment and

Discuss the A both th y 55% ay ir to

changes for USA or evised higher in 2019 as sho 2019 on M of

. es e the major sour N ay answer

• and e the er 2018-19. as the or 2019

shar er in of sho e and

likely w wn R

trade 2018-19. ts in eser oil ther .

in 10.2% v which e

payments; ts impor T e was ms and add them to a glossar

account 2018-19 able 4.13 B

of with Figure 4.9: T ank

Propose in ’ led balance of payments

ts impor ed s I

ustralian USA wn in . ndex to

• financial impor of A the The of a rise

balance ustralian y F R

in the global economy s A ces b rends in the T igur eser commodities in

eloping and OECD countries w ed manufactur

trends and policies. and of capital account

sour w e 4.9 v

capital ces to e B

EC, dev sour major follo ustralian due but w ank

AP ts, ’

the A s r

Australia’ capital for ose

of major e the been erms of T er ecast

of er impor cost e expected to moderate in 2020-21. b commodity prices

the y

the w w has

of for lo for

ws y of time Asia rade 1971 to 2021 the y:

balance sho (15.8%) ces er the terms

countr v

the e 4.4 sour o current account deficit

components balance tant within of

igur ASEAN trade

the and F major

and impor e

main ar

most chandise eements debt ser

ECONOMIC SKILLS agr

the liberalisation (f)

between balance mined (17.4%) countries t mer inter

EU single trade trade

deter impor ee

is the GDP); fr China. vicing ratio national competitiveness

Calculate account was ASEAN t and to and direct investment

• relationship the expor ts bilateral apan manufacturing industr

and s and J

currency (24.4%) ’ impor

of ea,

the current

a and or expor

China ustralia ts eements; K

the of A

value ts. in agr net errors and omissions

expor t diversification

Analyse the wth of TPP Thailand,

value impor o

on gr ratio and e, expor

• between the A

ts. The the ingapor net foreign debt y

how (i.e. S t price index

net income balance; payments impor AANZFT USA, financial account

intensity EC, the

relationship of AP

explain as net

trade O,

the to T such

eater W foreign

balance gr tners financial derivatives

Explain under par ts in 2018-19 net foreign liabilities

the equity

diagrams egion

of r

• acific trading foreign debt

P major

s

and financial account; ’ net primar

demand

The Workbooks include ustralia th East Asia 36.9%

and components A

the with Nor foreign

net secondar

in y income deficit

supply

equity

Use changes foreign exchange net ser

•

of y income

Figure 4.4: Major Sources of Australian Impor

under different exchange rate systems; and EU 17.4% foreign investment vices

impact

the . nominal exchange rate

Analyse goods balance por

• the Australian dollar vices such as education and tourism. ASEAN 15.8% goods credits tfolio investment

TOPIC TWO goods debits primary industr

real exchange rate

y integrated with the global economy and has strong trade links with major Asian USA 10.2% impor y

ter of commodities and ser real unit labour costs

practice HSC style ts as a percentage of GDP) has risen over time with t price index

tners such as China, Japan, the NIEs and ASEAN as well as the EU, USA and New Reser

Australia is ver ts and impor New Zealand 2.5% ve assets

trading par Source: Reser services industr

Zealand. Australia is a large expor y competitiveness and greater market access for Australian Other 17.2% structural change

s trade intensity (i.e. expor s negotiation of various bilateral (e.g. Korea, Japan and ve Bank of Australia (2019), © y

ts each accounting for 21% of GDP in 2018-19. This is a result of reductions in T ter

nment’ im Riley Publications Pty Ltd

Australia’ able 14b ms of trade

exports and impor Statement on Monetar

vices, Catalogue 5368.0, June. T © y Policy

T

domestic protection, increased industr im Riley Publications Pty Ltd

ts through the Australian gover , May

questions and answers. ear 12 Economics 2020 .

expor rade in Goods and Ser Y

China), regional (e.g. APEC and the TPP) and multilateral trade agreements (e.g. the WTO). , International T

Source: ABS (2019)

Y

ear 12 Economics 2020 Y

im Riley Publications Pty Ltd ear 12 Economics 2020

T

©

Secure Online Complete and Fax Form Email Orders to EFT Payments to

PayPal Ordering at to (02) 9972 0059 t.r.p@bigpond.com BSB 062 151

www.timriley.com.au Acc 1002 4319

NEW 2021 TEXTBOOK & WORKBOOK ORDER FORM & TAX INVOICE: ABN 30 063 689 412

Name: Address:

Department: Town/Suburb:

School/College: State: Postcode:

Phone: Fax: Email:

Charge my: Mastercard Visa

Print Cardholder’s Name: No:

Signature: Expiry Date: /

EFT PAYMENT BSB: 062 151 Account Number: 1002 4319 Account Name: Tim Riley Publications Pty Ltd

* SCHOOL ORDER NUMBER: Quantity Price Total

Year 11 Economics Textbook 2021ISBN 978-0-6485896-3-1 $72

Year 11 Economics Workbook 5th Edition 2019ISBN 978-0-6485896-0-0 $45

Year 11 Economics Package 2021ISBN 978-0-6485896-4-8 $94

1 x Year 11 Economics Textbook 2021 + 1 x Year 11 Economics Workbook 5th Edition 2019

Year 12 Economics Textbook 2021ISBN 978-0-6485896-1-7 $77

Year 12 Economics Workbook5th Edition 2019 ISBN 978-0-6480891-9-3 $45

Year 12 Economics Package 2021ISBN 978-0-6485896-2-4 $99

1 x Year 12 Economics Textbook 2021 + 1 x Year 12 Economics Workbook 5th Edition 2019

Postage and Handling Per Order $16.50

TOTAL ORDER

All prices include GST

TIM RILEY PUBLICATIONS PTY LTD

Ph (02) 9972 2059 Fax (02) 9972 0059 PO Box 455 DEE WHY NSW 2099

Email t.r.p@bigpond.com Web www.timriley.com.au

2021 Package flyer.indd 22021 Package flyer.indd 2 6/7/20 12:15 pm6/7/20 12:15 pm

no reviews yet

Please Login to review.