153x Filetype PDF File size 0.43 MB Source: nc.snps.edu.in

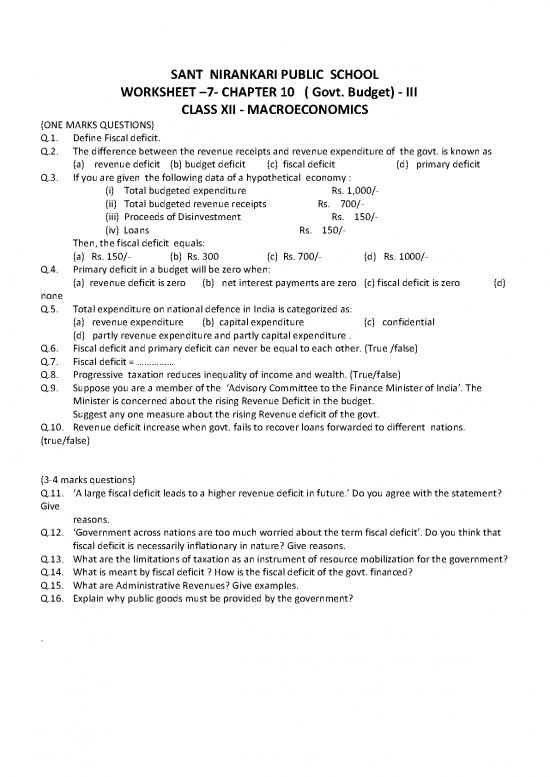

SANT NIRANKARI PUBLIC SCHOOL

WORKSHEET –7- CHAPTER 10 ( Govt. Budget) - III

CLASS XII - MACROECONOMICS

(ONE MARKS QUESTIONS)

Q.1. Define Fiscal deficit.

Q.2. The difference between the revenue receipts and revenue expenditure of the govt. is known as

(a) revenue deficit (b) budget deficit (c) fiscal deficit (d) primary deficit

Q.3. If you are given the following data of a hypothetical economy :

(i) Total budgeted expenditure Rs. 1,000/-

(ii) Total budgeted revenue receipts Rs. 700/-

(iii) Proceeds of Disinvestment Rs. 150/-

(iv) Loans Rs. 150/-

Then, the fiscal deficit equals:

(a) Rs. 150/- (b) Rs. 300 (c) Rs. 700/- (d) Rs. 1000/-

Q.4. Primary deficit in a budget will be zero when:

(a) revenue deficit is zero (b) net interest payments are zero (c) fiscal deficit is zero (d)

none

Q.5. Total expenditure on national defence in India is categorized as:

(a) revenue expenditure (b) capital expenditure (c) confidential

(d) partly revenue expenditure and partly capital expenditure .

Q.6. Fiscal deficit and primary deficit can never be equal to each other. (True /false)

Q.7. Fiscal deficit = ……………

Q.8. Progressive taxation reduces inequality of income and wealth. (True/false)

Q.9. Suppose you are a member of the ‘Advisory Committee to the Finance Minister of India’. The

Minister is concerned about the rising Revenue Deficit in the budget.

Suggest any one measure about the rising Revenue deficit of the govt.

Q.10. Revenue deficit increase when govt. fails to recover loans forwarded to different nations.

(true/false)

(3-4 marks questions)

Q.11. ‘A large fiscal deficit leads to a higher revenue deficit in future.’ Do you agree with the statement?

Give

reasons.

Q.12. ‘Government across nations are too much worried about the term fiscal deficit’. Do you think that

fiscal deficit is necessarily inflationary in nature? Give reasons.

Q.13. What are the limitations of taxation as an instrument of resource mobilization for the government?

Q.14. What is meant by fiscal deficit ? How is the fiscal deficit of the govt. financed?

Q.15. What are Administrative Revenues? Give examples.

Q.16. Explain why public goods must be provided by the government?

.

WORKSHEET – 8 -CHAPTER 10 ( Govt. Budget) - IV

CLASS XII - MACROECONOMICS

Q.1. From the following calculate a) Revenue deficit B) fiscal deficit c) Primary deficit

Items ( amount in rupees)

(i) Tax revenue 47

(ii) Capital receipts 34

(iii) Non-tax revenue 10

(iv) Borrowings 32

(v) Revenue expenditure 80

(vi) Interest payments 20

Q.2. From the following data of the govt. budget find (a) fiscal deficit (b) Primary deficit

Items ( amount in rupees)

(i) Revenue expenditue 70000

(ii) Borrowings 15000

(iii) Revenue receipts 50000

(iv) Interest payments 25% of revenue deficit

Q.3. From the following data about a govt. budget find:

a) Revenue deficit b) fiscal deficit c) Primary deficit

Items ( amount in rupees)

(i) Tax revenue 1037

(ii) Revenue expenditure 2811

(iii) Interest receipts by the govt. on net domestic lending 400

(iv) Dividends and profits on investments 600

(v) Recovery of loans 135

(vi) Capital expenditure 574

(vii) Proceeds from sale of shares in PSUs 100

(viii) Interest payments on accumulated debts 1013

Q.4. From the following data about a government budget calculate Primary deficit:

Items ( amount in rupees)

(i) Revenue deficit 40

(ii) Non-debt creating capital receipts 190

(iii) Tax revenue 125

(iv) Capital expenditure 220

(v) Interest payment 20

Q.5. Is the following revenue expenditure or capital expenditure in context of govt. budget. Give rasons

a) Expenditure on collection of taxes

b) Expenditure on purchasing computers

c) Expenditure on scholarships

d) Expenditure on building a bridge

no reviews yet

Please Login to review.