192x Filetype PDF File size 0.18 MB Source: www.msubaroda.ac.in

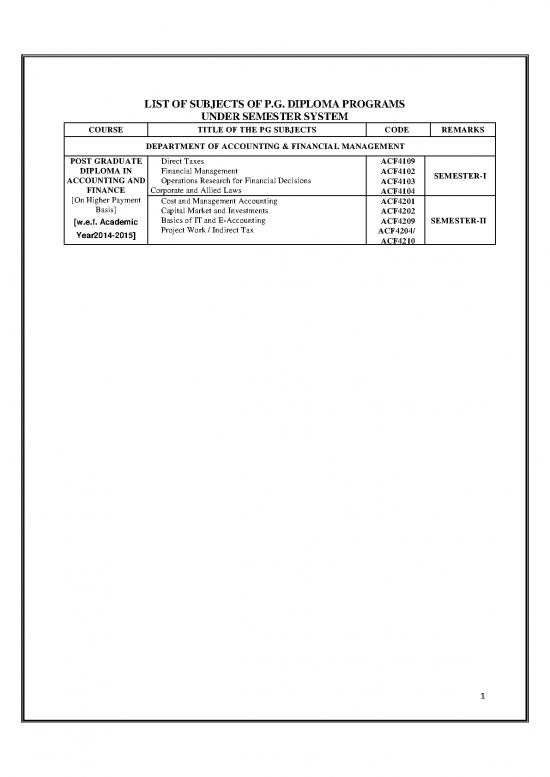

LIST OF SUBJECTS OF P.G. DIPLOMA PROGRAMS

UNDER SEMESTER SYSTEM

COURSE TITLE OF THE PG SUBJECTS CODE REMARKS

DEPARTMENT OF ACCOUNTING & FINANCIAL MANAGEMENT

POST GRADUATE Direct Taxes ACF4109

DIPLOMA IN Financial Management ACF4102 SEMESTER-I

ACCOUNTING AND Operations Research for Financial Decisions ACF4103

FINANCE Corporate and Allied Laws ACF4104

[On Higher Payment Cost and Management Accounting ACF4201

Basis] Capital Market and Investments ACF4202

[w.e.f. Academic Basics of IT and E-Accounting ACF4209 SEMESTER-II

Year2014-2015] Project Work / Indirect Tax ACF4204/

ACF4210

1

DETAILED SYLLABUS

DEPARTMENT OF ACCOUNTING & FINANCIAL

MANAGEMENT

POST GRADUATE DIPLOMA COURSES

DEPARTMENT OF ACCOUNTING & FINANCIAL MANAGEMENT

POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE

[w.e.f. Academic Year 2014-2015]

FACULTY OF COMMERCE

The Maharaja Sayajirao University of Baroda

Faculty of Commerce, ACADEMIC YEAR

Department of Accounting and Financial Management 2016-2017

Faculty of Commerce, Sayaji Gunj, Vadodara- 390002,

Contact details: 02652975768

POST GRADUATE DIPLOMA COURSES : 1 Year Diploma Course

YEAR I POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE CREDIT

Semester I [On Higher Payment Basis] HOURS

DIRECT TAXES

OBJECTIVES: To provide working knowledge in Direct Tax Laws applicable to business

COURSE CONTENT / SYLLABUS

UNIT-I 1. Taxation of Income under the head ' Profits and Gains from Business or Profession'.

2. Taxation of Income under the head 'Other Sources'.

UNIT-II

1.Taxation of Income under the head 'Capital Gains'.

UNIT-III 1. Provisions of Set off and Carry Forward of Losses.

2. Deductions from Gross Total Income.

3. Provisions regarding payment of Advance Income Tax and Tax deducted at source.

1. Filing of Original Returns, Revised returns, Belated Returns, Returns to be filed in response to notice under

UNIT-IV section 142(3)/147/153A etc.

2. Various types of Assessments- Scrutiny Assessment, Best Judgment Assessment Reopening of Assessment,

etc. and rectification of mistake.

REFERENCES

1. Direct Taxes Law & Practice By Dr. Vinod K. Singhania — Dr. Kapil Singhania — TAXMANNN Publication.

2. Direct Taxes Law & Practice By Dr. Cirish Ahuja — Dr. Ravi Gupta BHARAT Publication.

3. Direct Tax Laws By CA T.N..Manoharan — SNOW WHITE Publication.

2

1)N POST GRADUATE DIPLOMA COURSES

DEPARTMENT OF ACCOUNTING & FINANCIAL MANAGEMENT

POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE

[w.e.f. Academic Year 2014-2015]

FACULTY OF COMMERCE

The Maharaja Sayajirao University of Baroda

Faculty of Commerce, ACADEMIC YEAR

Department of Accounting and Financial Management 2016-2017

Faculty of Commerce, Sayaji Gunj, Vadodara- 390002,

Contact details: 02652975768

POST GRADUATE DIPLOMA COURSES : 1 Year Diploma Course

YEAR I POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE CREDIT

Semester I [On Higher Payment Basis] HOURS

FINANCIAL MANAGEMENT

OBJECTIVES: To provide a sound understanding of the central ideas and theories of modern finance and equip with the

analytical techniques helpful in financial decision making of a business firm.

COURSE CONTENT / SYLLABUS

UNIT-I 1) Introduction and Core Concepts, Objectives and Functions, Sources of Finance.

2) Financial Statement Analysis: Ratio Analysis, Du Pont Analysis.

UNIT-II 1)Working Capital :

Concept, Components, Operating Cycle & Factors Influencing Working Capital Requirements, Essentials of

Cash Management, Credit Management and Inventory Management, Current Assets Financing Policy,

Working Capital Financing.

UNIT-III 1) Cost of Capital

2) Capital Budgeting:

Process, Basic Principles, Appraisal Techniques: Discounted Pay-back Period, NPV, IRR and Benefit-Cost

Ratio, Capital Rationing.

UNIT-IV 1) Capital Structure:

2) Dividend Policy: Forms of Dividend – Indian & International Scenario, Payout Ratio and Rationale for

Dividend Stability, Bonus and Stock Splits

REFERENCES

1. Fundamentals of Financial Management by Prasanna Chandra (TMH)

2. Essentials of Financial Management by I. M. Pandey (Vikas)

3. Principles of Corporate Finance by Brealey, Myers, Allen & Mohanty (TMH)

4. Corporate Finance : Theory & Practice by Aswath Damodaran (John Wiley)

5. Corporate Finance: Theory & Practice by Vishwanath S.R. (Response Books/Sage)

6. Financial Management: An Introduction by Jim McMenamin (Oxford)

3

POST GRADUATE DIPLOMA COURSES

DEPARTMENT OF ACCOUNTING & FINANCIAL MANAGEMENT

POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE

[w.e.f. Academic Year 2014-2015]

FACULTY OF COMMERCE

The Maharaja Sayajirao University of Baroda

Faculty of Commerce, ACADEMIC YEAR

Department of Accounting and Financial Management 2016-2017

Faculty of Commerce, Sayaji Gunj, Vadodara- 390002,

Contact details: 02652975768

POST GRADUATE DIPLOMA COURSES : 1 Year Diploma Course

YEAR I POST GRADUATE DIPLOMA IN ACCOUNTING AND FINANCE CREDIT

Semester I [On Higher Payment Basis] HOURS

OPERATIONS RESEARCH FOR FINANCIAL DECISIONS

OBJECTIVES: To teach the application of scientific methods and techniques for financial decision-making problems.

COURSE CONTENT / SYLLABUS

1. Introduction to Operation Research:

Concept – nature-features- Scope –Scientific methods – Methodology- Applications – Limitations of OR.

UNIT-I 2. Linear Programming: Problem Formulation & Graphical Solution

Introduction- Mathematical formulations of the problems-General Models of LPP- Applications- Graphical

solution method.

3. Linear Programming: Simplex Method:

Introduction- Principle of Simplex method (Basic terms) – Computational aspect of simplex method

1. Replacement Decisions:

Introduction- Replacement problems

UNIT-II 2. Simulation Models:

Introduction- Definition- methodology for simulation- Simulation of Inventory problems-Investments

decision through simulation problems.

3. Business Forecasting:

Meaning- Concepts-Importance- Techniques of forecasting- Theories

1. Transportation and Transshipment Problem:

Introduction-L.P.Formulation-Solution procedure- Methods – Test for optimality Unbalanced

UNIT-III Transportation problem- Degeneracy

2. Assignment Problem:

Introduction-Approach of the Assignment Model-Maximization and Unbalanced assignment problem –

Restriction on assignment

1. Project Planning/Network Analysis: PERT & CPM

UNIT-IV Introduction-Network model and its applications- Concepts and its applications- Critical path method

(CPM)-Programme Evaluation and Review Technique (PERT)

2. Game theory

Introduction- Terminology- Methods Limitations- Significance

REFERENCES

1. Operations Research by Kantiswaroop (Sultan Chand)

2. Operation Research by V.K.Kapoor (Sultan Chand)

3. Operation Research by K. Shridhara Bhatt. (Himalaya Publishing House)

4

no reviews yet

Please Login to review.